Page 27 - International Taxation IRS Training Guides

P. 27

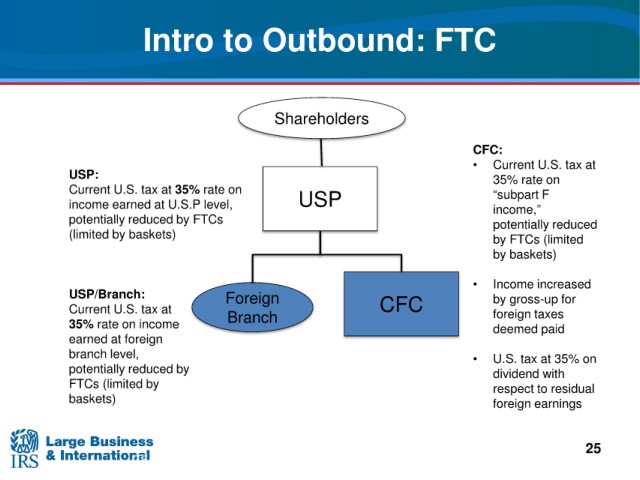

Intro to Outbound:

FTC

Shareholders

CFC:

• Current U.S. tax at

USP:

35% rate on

Current U.S. tax at 35% rate on

“subpart F

income earned at U.S.P level,

USP income,”

potentially reduced by FTCs

potentially reduced

(limited by baskets)

by FTCs (limited

by baskets)

• Income increased

USP/Branch: Foreign by gross-up for

Current U.S. tax at Branch CFC foreign taxes

35% rate on income deemed paid

earned at

foreign

branch level, • U.S. tax

at 35% on

potentially reduced by dividend with

FTCs (limited by respect to

residual

baskets) foreign earnings

25