Page 31 - International Taxation IRS Training Guides

P. 31

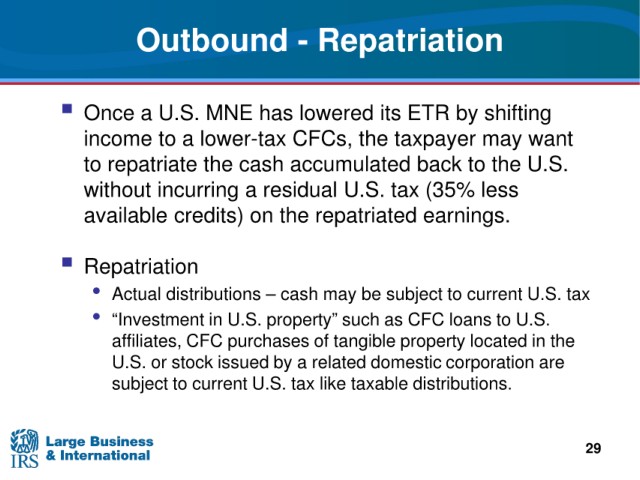

Outbound - Repatriation

Once a U.S. MNE

has lowered its ETR by shifting

CFCs, the taxpayer may want

income to a lower-tax

to the U.S.

to repatriate the cash accumulated back

without

incurring a residual U.S. tax (35% less

on the repatriated earnings.

available credits)

Repatriation

distributions – cash may be subject to current U.S. tax

• Actual

in U.S. property” such as CFC loans to U.S.

• “Investment

affiliates,

CFC purchases of tangible property located in the

stock issued by a related domestic corporation are

U.S. or

subject

to current U.S. tax like taxable distributions.

29