Page 34 - International Taxation IRS Training Guides

P. 34

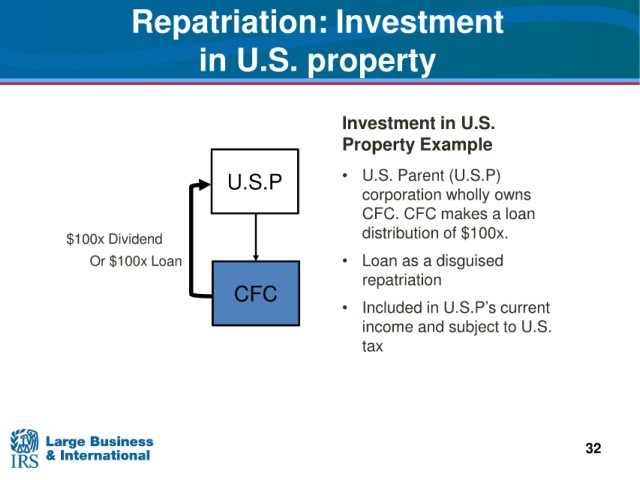

Repatriation: Investment

in U.S. property

U.S.

Investment i n

Property

Example

(U.S.P)

U.S.P • U.S. Parent

corporation wholly

owns

CFC. CFC makes a loan

$100x.

$100x Dividend distribution of

a disguised

$100x Loan

Or • Loan as

repatriation

CFC

• Included in U.S.P’s current

income and subject

to U.S.

tax

32