Page 37 - International Taxation IRS Training Guides

P. 37

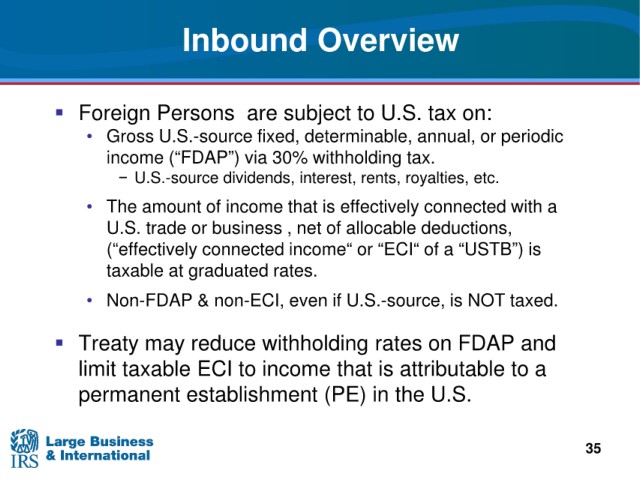

Inbound Overview

Foreign Persons are subject to U.S. tax on:

• Gross U.S.-source fixed, determinable, annual, or periodic

income (“FDAP”) via 30% withholding tax.

− U.S.-source dividends,

interest, rents, royalties, etc.

• The amount of income that is effectively connected with a

U.S. trade or business , net of allocable deductions,

(“effectively connected income“ or “ECI“ of a “USTB”) is

taxable at graduated rates.

• Non-FDAP & non-ECI, even if U.S.-source, is NOT taxed.

Treaty may reduce withholding rates on FDAP and

limit taxable ECI to income that is attributable to a

permanent establishment (PE) in the U.S.

35