Page 39 - International Taxation IRS Training Guides

P. 39

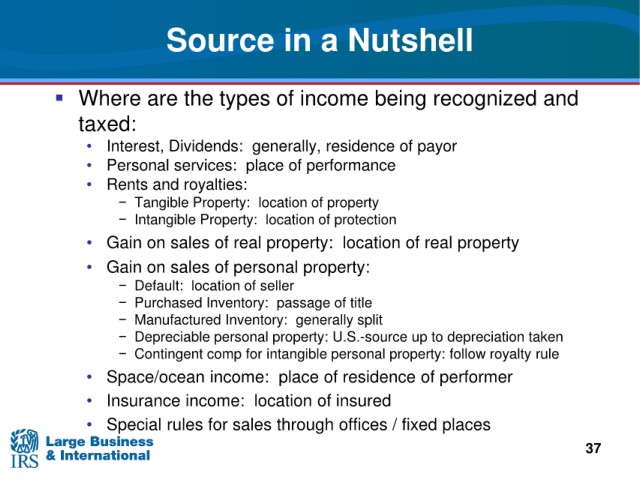

Source in a Nutshell

Where are the types of income being recognized and

taxed:

• Interest, generally, residence of payor

Dividends:

place of performance

• Personal services:

• Rents and royalties:

− Tangible Property: location of property

− Intangible Property: location of protection

• Gain on sales of real property: location of real property

• Gain on sales of personal property:

− Default: location of seller

− Purchased Inventory: passage of title

− Manufactured Inventory: generally split

− Depreciable personal property: U.S.-source up to depreciation taken

intangible personal property: follow royalty rule

− Contingent comp for

place of residence of performer

• Space/ocean income:

• Insurance income:

location of insured

rules for sales through offices / fixed places

• Special

37