Page 43 - International Taxation IRS Training Guides

P. 43

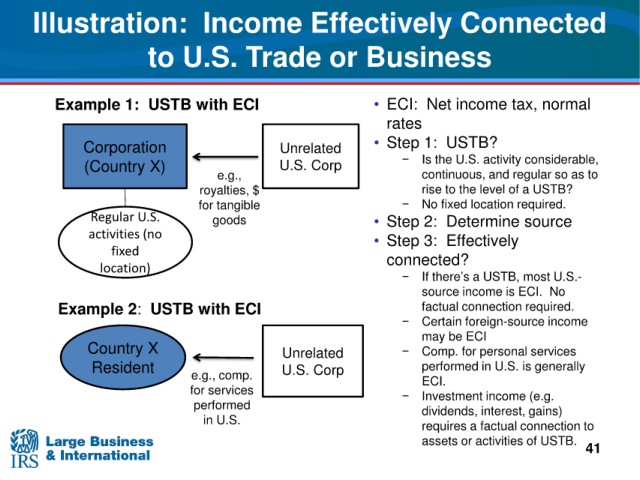

Illustration: Income

Effectively Connected

to

U.S. Trade or Business

ECI

Example 1: USTB with • ECI: Net income tax, normal

rates

USTB?

Corporation Unrelated • Step 1:

(Country X) U.S. Corp − Is the U.S. activity considerable,

e.g., continuous, and regular so as to

royalties, $ rise to the level of a USTB?

for tangible − No fixed location required.

Regular U.S. goods • Step 2: Determine source

activities (no • Step 3: Effectively

fixed connected?

location)

− If there’s a USTB, most U.S.

source income is ECI. No

Example 2: USTB with factual connection required.

ECI

− Certain foreign-source income

may be ECI

Country X Unrelated − Comp. for personal services

Resident e.g., comp. U.S. Corp performed in U.S. is generally

ECI.

for services − Investment income (e.g.

performed dividends, interest, gains)

in U.S. requires a factual connection to

assets or activities of USTB.

41