Page 44 - International Taxation IRS Training Guides

P. 44

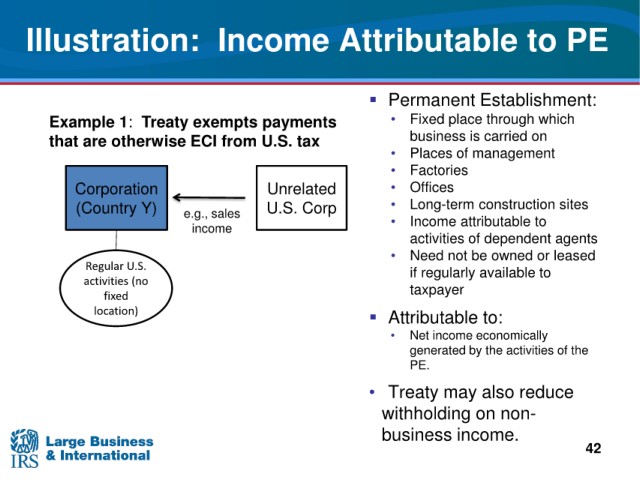

Illustration: Income Attributable to PE

Permanent Establishment:

Example 1: Treaty exempts payments • Fixed place through which

carried on

tax

that are otherwise ECI from U.S. business is

• Places of management

• Factories

Corporation Unrelated • Offices

(Country Y) e.g., sales

U.S. • Long-term construction sites

Corp

income

• Income attributable to

activities of dependent agents

• Need not be owned or leased

Regular U.S. if regularly available to

activities (no

fixed taxpayer

location) Attributable to:

• Net income economically

generated by the activities of the

PE.

• Treaty

may also reduce

withholding on non

business

income.

42