Page 42 - International Taxation IRS Training Guides

P. 42

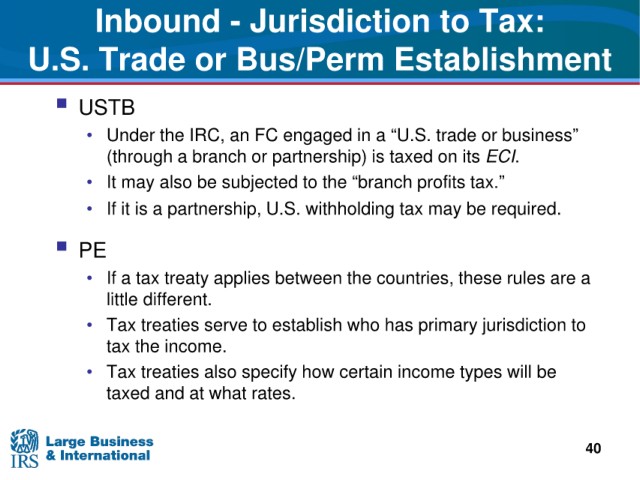

Inbound - Jurisdiction to Tax:

U.S.

Trade or Bus/Perm Establishment

USTB

the IRC, an FC engaged in a “U.S. trade or business”

• Under

(through a branch or

partnership) is taxed on its ECI.

• It may also be subjected to the “branch profits tax.”

a partnership, U.S. withholding tax may be required.

• If i t i s

PE

• If a tax treaty applies between the countries, these rules are a

little

different.

treaties serve to establish who has primary jurisdiction to

• Tax

tax

the income.

treaties also specify how certain income types will be

• Tax

what rates.

taxed and at

40