Page 40 - International Taxation IRS Training Guides

P. 40

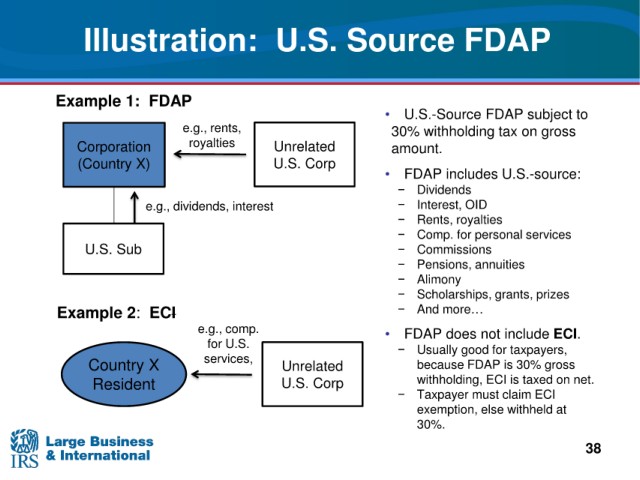

Illustration: U.S. Source FDAP

Example 1: FDAP

• U.S.-Source FDAP subject to

e.g., rents, 30%

withholding tax on gross

Corporation royalties Unrelated amount.

(Country X) U.S. Corp

• FDAP includes U.S.-source:

− Dividends

e.g., dividends, interest − Interest, OID

− Rents, royalties

− Comp. for personal services

U.S. Sub − Commissions

− Pensions, annuities

− Alimony

− Scholarships, grants, prizes

Example 2: ECI − And more…

e.g., comp. • FDAP does not include ECI.

for U.S. − Usually good for taxpayers,

Country X services, Unrelated because FDAP is

30% gross

Resident U.S. Corp withholding, ECI is taxed on net.

− Taxpayer must claim ECI

exemption, else withheld at

30%.

38