Page 41 - International Taxation IRS Training Guides

P. 41

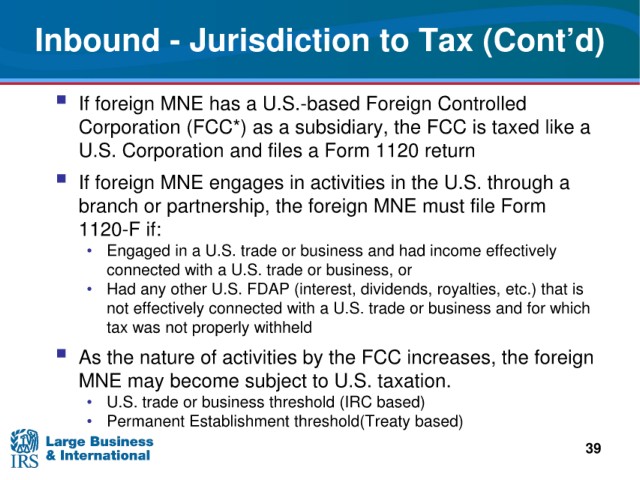

Inbound - Jurisdiction to Tax

(Cont’d)

If foreign MNE has a U.S.-based Foreign Controlled

Corporation (FCC*) as a subsidiary, the FCC is taxed like a

U.S. Corporation and files a Form 1120 return

If foreign MNE engages in activities in the U.S. through a

branch or partnership, the foreign MNE must file Form

1120-F if:

• Engaged in a U.S. trade or business and had income effectively

connected with a U.S. trade or business, or

• Had any other U.S. FDAP (interest, dividends, royalties, etc.) that is

not effectively connected with a U.S. trade or business and for which

tax was not properly withheld

As the nature of activities by the FCC increases, the foreign

MNE may become subject to U.S. taxation.

• U.S. trade or business threshold (IRC based)

• Permanent Establishment threshold(Treaty based)

39