Page 33 - International Taxation IRS Training Guides

P. 33

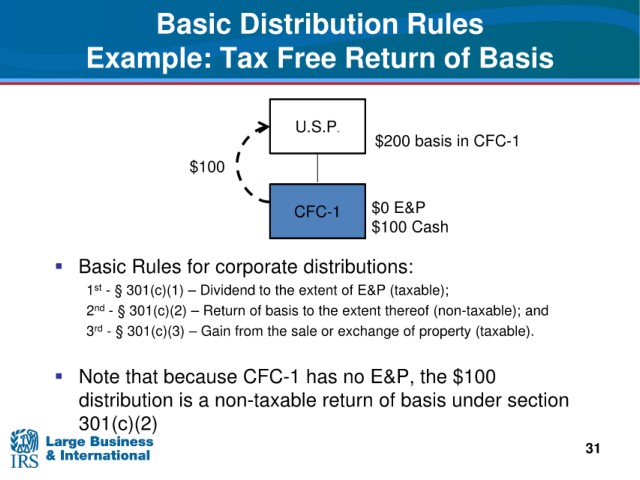

Basic

Distribution Rules

Example: Tax

Free Return of Basis

U.S.P.

$200 basis in CFC-1

$100

CFC-1 $0 E&P

$100 Cash

Basic Rules for corporate distributions:

1 - § 301(c)(1) – Dividend to the extent of E&P (taxable);

st

2 nd - § 301(c)(2) – Return of basis to the extent thereof (non-taxable); and

3 - § 301(c)(3) – Gain from the sale or exchange of property (taxable).

rd

Note that because CFC-1 has no E&P, the $100

distribution is a non-taxable return of basis under section

301(c)(2)

31