Page 32 - International Taxation IRS Training Guides

P. 32

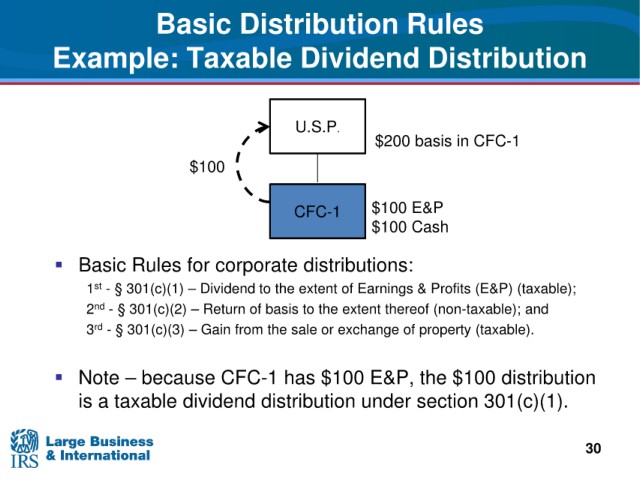

Basic

Distribution Rules

Example: Taxable

Dividend Distribution

U.S.P.

$200 basis in CFC-1

$100

CFC-1 $100 E&P

$100 Cash

Rules for corporate distributions:

Basic

1 - § 301(c)(1) – Dividend to the extent of Earnings & Profits (E&P) (taxable);

st

2 nd - § 301(c)(2) – Return of basis to the extent thereof (non-taxable); and

3 - § 301(c)(3) – Gain from the sale or exchange of property (taxable).

rd

Note – because CFC-1 has $100 E&P, the $100 distribution

section 301(c)(1).

is a taxable dividend distribution under

30