Page 304 - International Taxation IRS Training Guides

P. 304

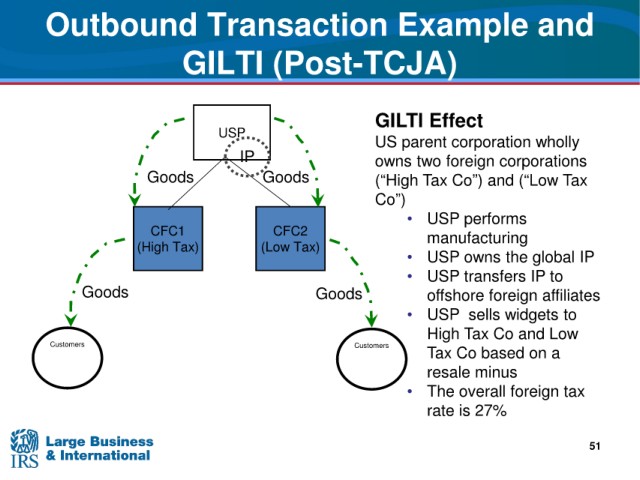

Outbound Transaction Example and

GILTI (Post-TCJA)

GILTI Effect

USP US parent corporation wholly

IP owns two foreign corporations

Goods Goods (“High Tax Co”) and (“Low Tax

Co”)

• USP performs

CFC1 CFC2

(High Tax) (Low Tax) manufacturing

the global IP

• USP owns

• USP transfers IP to

Goods Goods offshore foreign affiliates

widgets to

• USP sells

High Tax Co and Low

Customers Customers

Tax Co based on a

resale minus

• The overall foreign tax

rate is 27%

51