Page 54 - International Taxation IRS Training Guides

P. 54

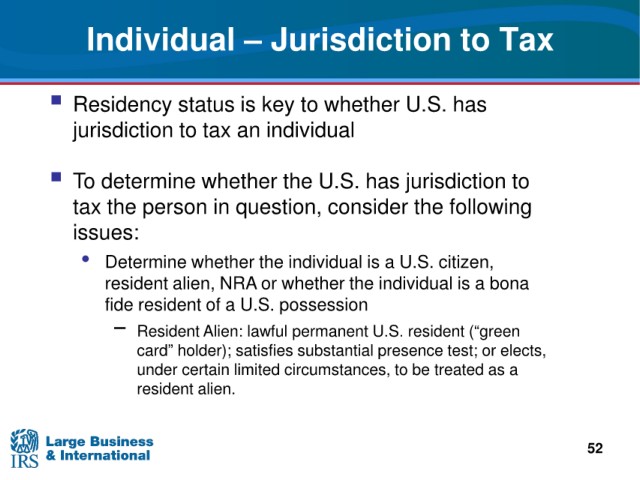

Individual – Jurisdiction to Tax

Residency status i s

key to whether U.S. has

jurisdiction to tax

an individual

To determine whether the U.S. has

jurisdiction to

tax the person in question,

consider the following

issues:

whether the individual is a U.S. citizen,

• Determine

alien, NRA or whether the individual is a bona

resident

fide resident

of a U.S. possession

Alien: lawful permanent U.S. resident (“green

− Resident

card”

holder); satisfies substantial presence test; or elects,

under certain limited circumstances, to be treated as a

resident alien.

52