Page 55 - International Taxation IRS Training Guides

P. 55

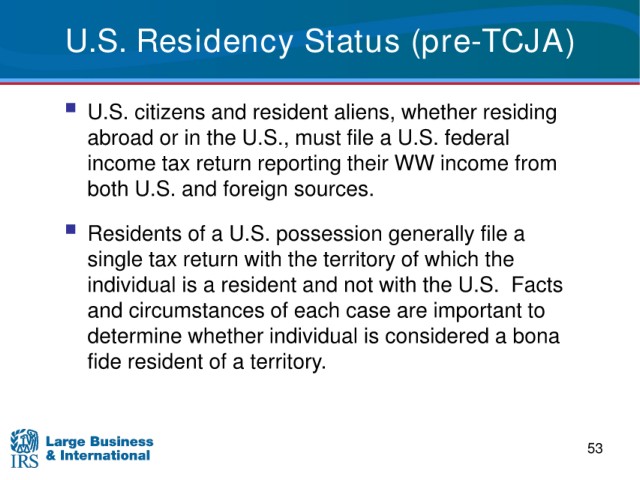

U.S.

Residency Status (pre-TCJA)

whether residing

U.S. citizens and resident aliens,

must file a U.S. federal

abroad or in the U.S.,

income from

income tax return reporting their WW

and foreign sources.

both U.S.

a U.S. possession generally file a

Residents of

single tax return with the territory

of which the

individual is Facts

a resident and not with the U.S.

and circumstances

of each case are important to

considered a bona

determine whether individual is

fide resident

of a territory.

53