Page 51 - International Taxation IRS Training Guides

P. 51

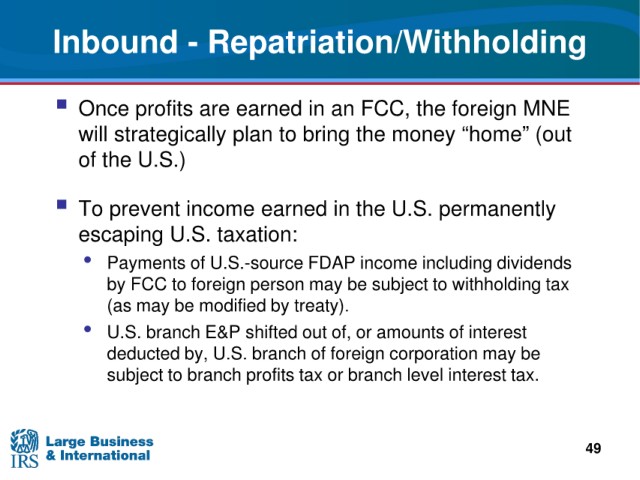

Inbound - Repatriation/Withholding

the foreign MNE

Once profits are earned in an FCC,

strategically plan to bring the money “home” (out

will

of the U.S.)

To prevent income earned in the U.S. permanently

escaping U.S. taxation:

• Payments o

f U.S.-source FDAP income including dividends

FCC to foreign person may be subject to withholding tax

by

may be modified by treaty).

(as

• U.S.

branch E&P shifted out of, or amounts of interest

by, U.S. branch of foreign corporation may be

deducted

subject

to branch profits tax or branch level interest tax.

49