Page 89 - International Taxation IRS Training Guides

P. 89

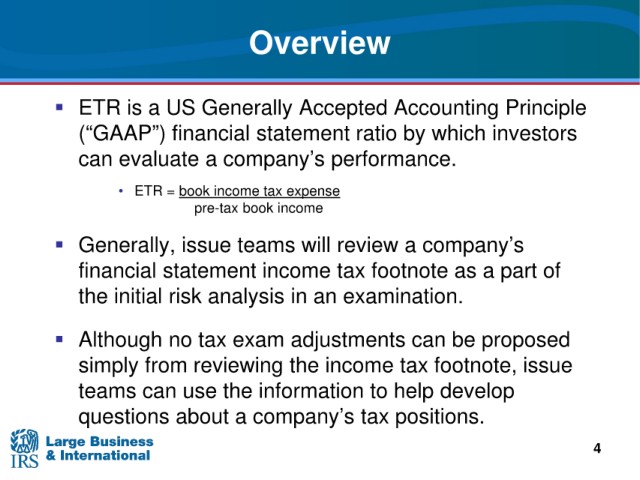

Overview

ETR is a US Generally Accepted Accounting Principle

(“GAAP”) financial statement ratio by which investors

can evaluate a company’s performance.

• ETR = book income tax expense

pre-tax

book income

Generally, issue teams

will review a company’s

statement income tax footnote as a part of

financial

the initial

risk analysis in an examination.

Although no tax exam

adjustments can be proposed

simply

from reviewing the income tax footnote, issue

teams

can use the information to help develop

tax positions.

questions about a company’s

4