Page 94 - International Taxation IRS Training Guides

P. 94

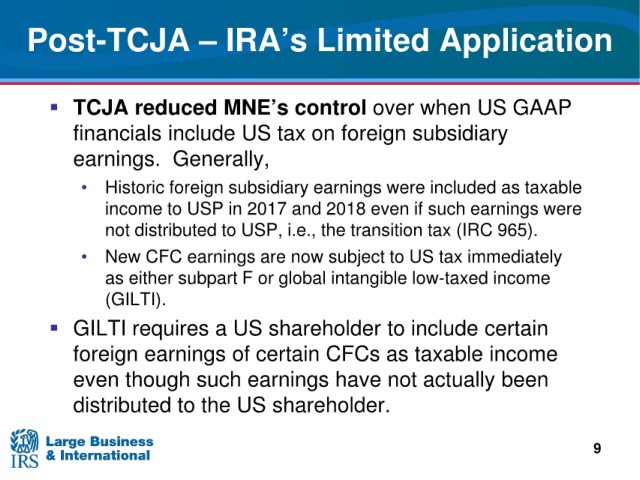

Post-TCJA – IRA’s Limited Application

reduced MNE’s control over when US GAAP

TCJA

include US tax on foreign subsidiary

financials

earnings. Generally,

• Historic

foreign subsidiary earnings were included as taxable

income to USP

in 2017 and 2018 even if such earnings were

distributed to USP, i.e., the transition tax (IRC 965).

not

CFC earnings are now subject to US tax immediately

• New

either subpart F or global intangible low-taxed income

as

(GILTI).

GILTI

requires a US shareholder to include certain

foreign earnings of

certain CFCs as taxable income

even though such earnings

have not actually been

distributed to the US

shareholder.

9