Page 93 - International Taxation IRS Training Guides

P. 93

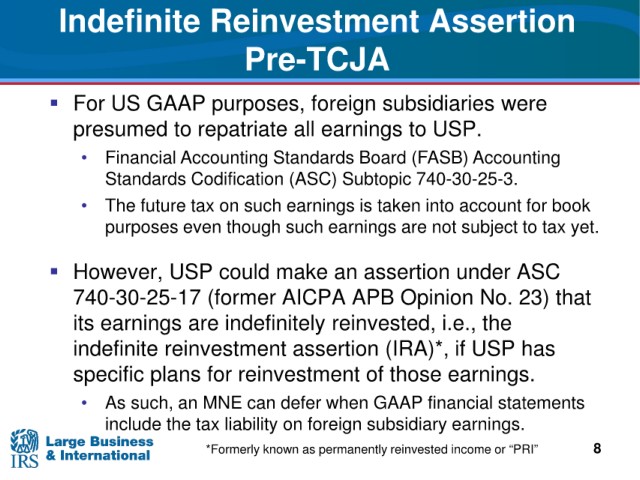

Indefinite Reinvestment

Assertion

Pre-TCJA

GAAP purposes, foreign subsidiaries were

For US

earnings to USP.

presumed to repatriate all

• Financial Accounting Standards

Board (FASB) Accounting

Standards

Codification (ASC) Subtopic 740-30-25-3.

on such earnings is taken into account for book

• The future tax

even though such earnings are not subject to tax yet.

purposes

However, USP could make an assertion under

ASC

AICPA APB Opinion No. 23) that

740-30-25-17 (former

are indefinitely reinvested, i.e., the

its earnings

indefinite reinvestment

assertion (IRA)*, if USP has

specific

plans for reinvestment of those earnings.

• As

such, an MNE can defer when GAAP financial statements

liability on foreign subsidiary earnings.

include the tax

*Formerly known as permanently reinvested income or “PRI” 8