Page 12 - Family Law Services

P. 12

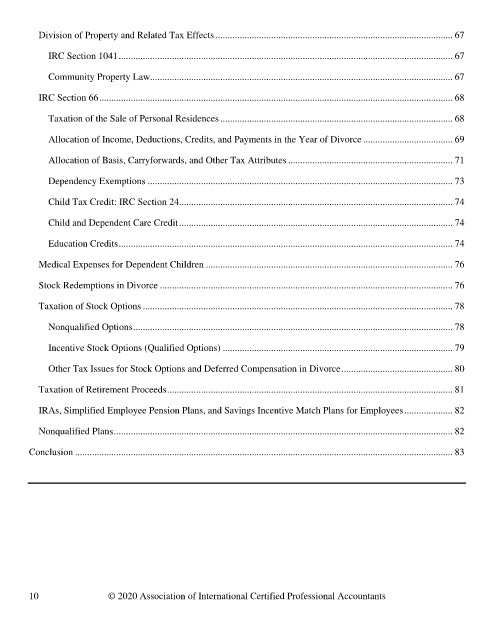

Division of Property and Related Tax Effects .................................................................................................. 67

IRC Section 1041 .......................................................................................................................................... 67

Community Property Law............................................................................................................................. 67

IRC Section 66 .................................................................................................................................................. 68

Taxation of the Sale of Personal Residences ................................................................................................ 68

Allocation of Income, Deductions, Credits, and Payments in the Year of Divorce ..................................... 69

Allocation of Basis, Carryforwards, and Other Tax Attributes .................................................................... 71

Dependency Exemptions .............................................................................................................................. 73

Child Tax Credit: IRC Section 24 ................................................................................................................. 74

Child and Dependent Care Credit ................................................................................................................. 74

Education Credits .......................................................................................................................................... 74

Medical Expenses for Dependent Children ...................................................................................................... 76

Stock Redemptions in Divorce ......................................................................................................................... 76

Taxation of Stock Options ................................................................................................................................ 78

Nonqualified Options .................................................................................................................................... 78

Incentive Stock Options (Qualified Options) ............................................................................................... 79

Other Tax Issues for Stock Options and Deferred Compensation in Divorce .............................................. 80

Taxation of Retirement Proceeds ...................................................................................................................... 81

IRAs, Simplified Employee Pension Plans, and Savings Incentive Match Plans for Employees .................... 82

Nonqualified Plans ............................................................................................................................................ 82

Conclusion ............................................................................................................................................................ 83

10 © 2020 Association of International Certified Professional Accountants