Page 7 - Supplement to Income Tax 2020

P. 7

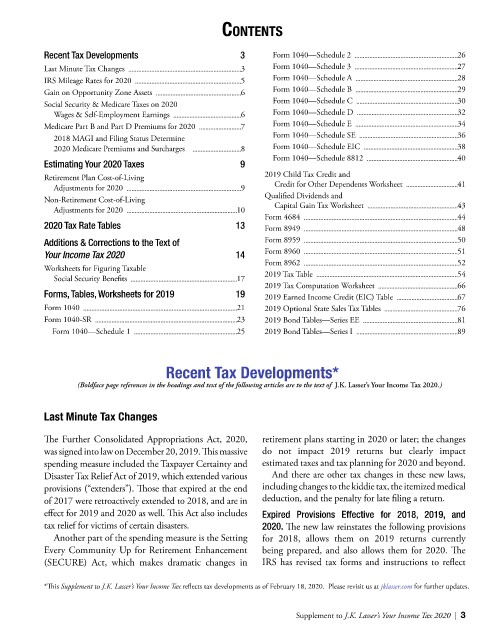

Contents

Recent Tax Developments 3 Form 1040—Schedule 2 26

Last Minute Tax Changes 3 Form 1040—Schedule 3 27

IRS Mileage Rates for 2020 5 Form 1040—Schedule A 28

Gain on Opportunity Zone Assets 6 Form 1040—Schedule B 29

Form 1040—Schedule C 30

Social Security & Medicare Taxes on 2020

Wages & Self-Employment Earnings 6 Form 1040—Schedule D 32

Medicare Part B and Part D Premiums for 2020 7 Form 1040—Schedule E 34

2018 MAGI and Filing Status Determine Form 1040—Schedule SE 36

2020 Medicare Premiums and Surcharges 8 Form 1040—Schedule EIC 38

Form 1040—Schedule 8812 40

Estimating Your 2020 Taxes 9

Retirement Plan Cost-of-Living 2019 Child Tax Credit and

Adjustments for 2020 9 Credit for Other Dependents Worksheet 41

Non-Retirement Cost-of-Living Qualified Dividends and

Adjustments for 2020 10 Capital Gain Tax Worksheet 43

Form 4684 44

2020 Tax Rate Tables 13 Form 8949 48

Additions & Corrections to the Text of Form 8959 50

Your Income Tax 2020 14 Form 8960 51

Form 8962 52

Worksheets for Figuring Taxable

Social Security Benefits 17 2019 Tax Table 54

2019 Tax Computation Worksheet 66

Forms, Tables, Worksheets for 2019 19 2019 Earned Income Credit (EIC) Table 67

Form 1040 21 2019 Optional State Sales Tax Tables 76

Form 1040-SR 23 2019 Bond Tables—Series EE 81

Form 1040—Schedule 1 25 2019 Bond Tables—Series I 89

Recent Tax Developments*

(Boldface page references in the headings and text of the following articles are to the text of J.K. Lasser’s Your Income Tax 2020.)

Last Minute Tax Changes

The Further Consolidated Appropriations Act, 2020, retirement plans starting in 2020 or later; the changes

was signed into law on December 20, 2019. This massive do not impact 2019 returns but clearly impact

spending measure included the Taxpayer Certainty and estimated taxes and tax planning for 2020 and beyond.

Disaster Tax Relief Act of 2019, which extended various And there are other tax changes in these new laws,

provisions (“extenders”). Those that expired at the end including changes to the kiddie tax, the itemized medical

of 2017 were retroactively extended to 2018, and are in deduction, and the penalty for late filing a return.

effect for 2019 and 2020 as well. This Act also includes Expired Provisions Effective for 2018, 2019, and

tax relief for victims of certain disasters. 2020. The new law reinstates the following provisions

Another part of the spending measure is the Setting for 2018, allows them on 2019 returns currently

Every Community Up for Retirement Enhancement being prepared, and also allows them for 2020. The

(SECURE) Act, which makes dramatic changes in IRS has revised tax forms and instructions to reflect

*This Supplement to J.K. Lasser’s Your Income Tax reflects tax developments as of February 18, 2020. Please revisit us at jklasser.com for further updates.

Supplement to J.K. Lasser’s Your Income Tax 2020 | 3