Page 12 - Supplement to Income Tax 2020

P. 12

Recent Tax Developments*

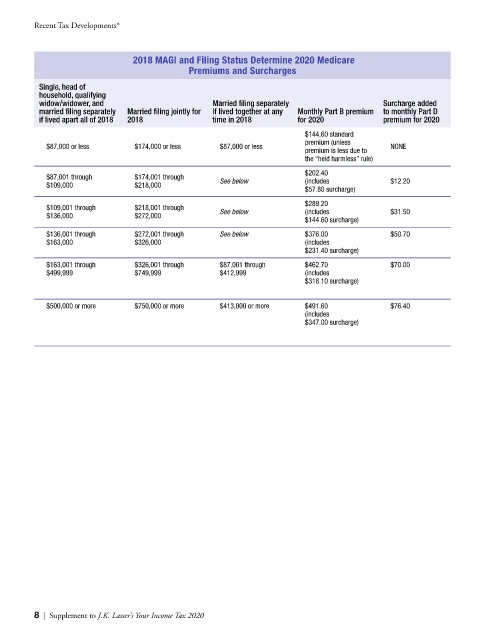

2018 MAGI and Filing Status Determine 2020 Medicare

Premiums and Surcharges

Single, head of

household, qualifying

widow/widower, and Married filing separately Surcharge added

married filing separately Married filing jointly for if lived together at any Monthly Part B premium to monthly Part D

if lived apart all of 2018 2018 time in 2018 for 2020 premium for 2020

$144,60 standard

premium (unless

$87,000 or less $174,000 or less $87,000 or less NONE

premium is less due to

the “held harmless” rule)

$202.40

$87,001 through $174,001 through See below (includes $12.20

$109,000 $218,000

$57.80 surcharge)

$289.20

$109,001 through $218,001 through See below (includes $31.50

$136,000 $272,000

$144.60 surcharge)

$136,001 through $272,001 through See below $376.00 $50.70

$163,000 $326,000 (includes

$231.40 surcharge)

$163,001 through $326,001 through $87,001 through $462.70 $70.00

$499,999 $749,999 $412,999 (includes

$318.10 surcharge)

$500,000 or more $750,000 or more $413,000 or more $491.60 $76.40

(includes

$347.00 surcharge)

8 | Supplement to J.K. Lasser’s Your Income Tax 2020