Page 350 - COSO Guidance Book

P. 350

8 | Risk Assessment in Practice | Thought Leadership in ERM

Assess Risks

Risk assessment is often performed as a two-stage The quality of the analysis depends on the accuracy and

process. An initial screening of the risks and opportunities completeness of the numerical values and the validity of the

is performed using qualitative techniques followed by a models used. Model assumptions and uncertainty should be

more quantitative treatment of the most important risks and clearly communicated and evaluated using techniques such

opportunities lending themselves to quantification (not all as sensitivity analysis.

risks are meaningfully quantifiable). Qualitative assessment

consists of assessing each risk and opportunity according Both qualitative and quantitative techniques have advantages

to descriptive scales as described in the previous section. and disadvantages. Most enterprises begin with qualitative

Quantitative analysis requires numerical values for both assessments and develop quantitative capabilities over time

impact and likelihood using data from a variety of sources. as their decision-making needs dictate.

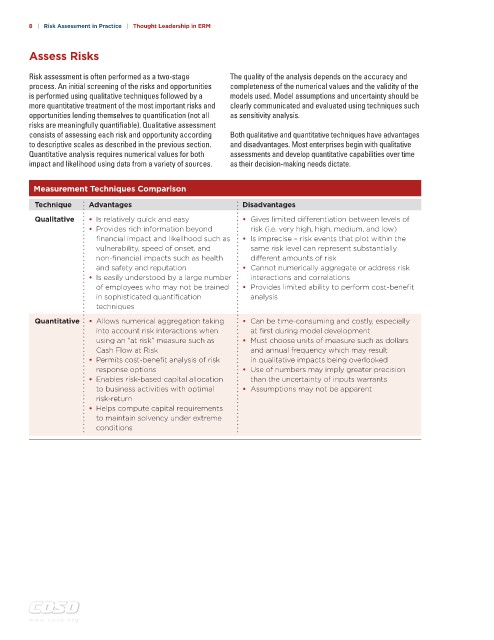

Measurement Techniques Comparison

Technique Advantages Disadvantages

Qualitative • Is relatively quick and easy • Gives limited differentiation between levels of

• Provides rich information beyond risk (i.e. very high, high, medium, and low)

financial impact and likelihood such as • Is imprecise – risk events that plot within the

vulnerability, speed of onset, and same risk level can represent substantially

non-financial impacts such as health different amounts of risk

and safety and reputation • Cannot numerically aggregate or address risk

• Is easily understood by a large number interactions and correlations

of employees who may not be trained • Provides limited ability to perform cost-benefit

in sophisticated quantification analysis

techniques

Quantitative • Allows numerical aggregation taking • Can be time-consuming and costly, especially

into account risk interactions when at first during model development

using an “at risk” measure such as • Must choose units of measure such as dollars

Cash Flow at Risk and annual frequency which may result

• Permits cost-benefit analysis of risk in qualitative impacts being overlooked

response options • Use of numbers may imply greater precision

• Enables risk-based capital allocation than the uncertainty of inputs warrants

to business activities with optimal • Assumptions may not be apparent

risk-return

• Helps compute capital requirements

to maintain solvency under extreme

conditions

w w w . c o s o . o r g