Page 151 - IRS Plan

P. 151

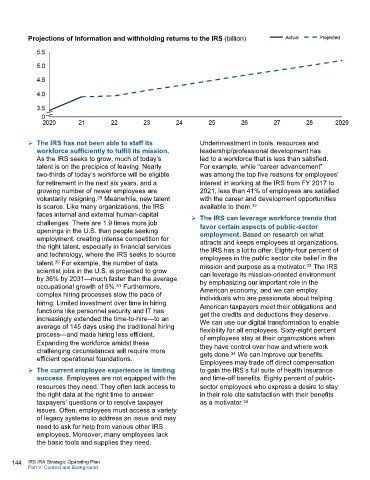

Ø The IRS has not been able to staff its Underinvestment in tools, resources and

workforce sufficiently to fulfill its mission. leadership/professional development has

As the IRS seeks to grow, much of today’s led to a workforce that is less than satisfied.

talent is on the precipice of leaving. Nearly For example, while “career advancement”

two-thirds of today’s workforce will be eligible was among the top five reasons for employees’

for retirement in the next six years, and a interest in working at the IRS from FY 2017 to

growing number of newer employees are 2021, less than 41% of employees are satisfied

voluntarily resigning. 29 Meanwhile, new talent with the career and development opportunities

is scarce. Like many organizations, the IRS available to them. 32

faces internal and external human-capital Ø The IRS can leverage workforce trends that

challenges. There are 1.9 times more job favor certain aspects of public-sector

openings in the U.S. than people seeking employment. Based on research on what

employment, creating intense competition for attracts and keeps employees at organizations,

the right talent, especially in financial services the IRS has a lot to offer. Eighty-four percent of

and technology, where the IRS seeks to source employees in the public sector cite belief in the

talent. 30 For example, the number of data mission and purpose as a motivator. 33 The IRS

scientist jobs in the U.S. is projected to grow can leverage its mission-oriented environment

by 36% by 2031—much faster than the average by emphasizing our important role in the

occupational growth of 5%. 31 Furthermore, American economy, and we can employ

complex hiring processes slow the pace of individuals who are passionate about helping

hiring. Limited investment over time in hiring American taxpayers meet their obligations and

functions like personnel security and IT has get the credits and deductions they deserve.

increasingly extended the time-to-hire—to an We can use our digital transformation to enable

average of 145 days using the traditional hiring flexibility for all employees. Sixty-eight percent

process—and made hiring less efficient. of employees stay at their organizations when

Expanding the workforce amidst these they have control over how and where work

challenging circumstances will require more gets done. 34 We can improve our benefits.

efficient operational foundations.

Employees may trade off direct compensation

Ø The current employee experience is limiting to gain the IRS’s full suite of health insurance

success. Employees are not equipped with the and time-off benefits. Eighty percent of public-

resources they need. They often lack access to sector employees who express a desire to stay

the right data at the right time to answer in their role cite satisfaction with their benefits

taxpayers’ questions or to resolve taxpayer as a motivator. 35

issues. Often, employees must access a variety

of legacy systems to address an issue and may

need to ask for help from various other IRS

employees. Moreover, many employees lack

the basic tools and supplies they need.

144 IRS IRA Strategic Operating Plan

Part V: Context and Background