Page 70 - IRS Plan

P. 70

Part III

Part I Part II Obj 1 Obj 2 Obj 3 Obj 4 Obj 5 Part IV Part V

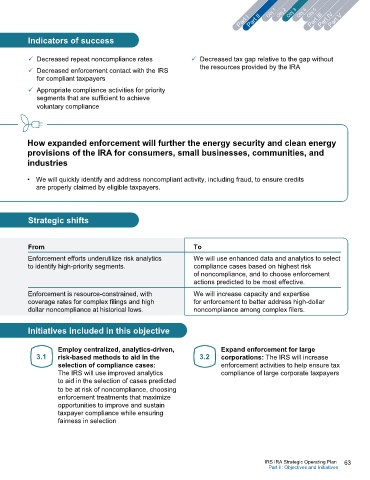

Indicators of success

ü Decreased repeat noncompliance rates ü Decreased tax gap relative to the gap without

the resources provided by the IRA

ü Decreased enforcement contact with the IRS

for compliant taxpayers

ü Appropriate compliance activities for priority

segments that are sufficient to achieve

voluntary compliance

How expanded enforcement will further the energy security and clean energy

provisions of the IRA for consumers, small businesses, communities, and

industries

• We will quickly identify and address noncompliant activity, including fraud, to ensure credits

are properly claimed by eligible taxpayers.

Strategic shifts

From To

Enforcement efforts underutilize risk analytics We will use enhanced data and analytics to select

to identify high-priority segments. compliance cases based on highest risk

of noncompliance, and to choose enforcement

actions predicted to be most effective.

Enforcement is resource-constrained, with We will increase capacity and expertise

coverage rates for complex filings and high for enforcement to better address high-dollar

dollar noncompliance at historical lows. noncompliance among complex filers.

Initiatives included in this objective

Employ centralized, analytics-driven, Expand enforcement for large

3.1 risk-based methods to aid in the 3.2 corporations: The IRS will increase

selection of compliance cases: enforcement activities to help ensure tax

The IRS will use improved analytics compliance of large corporate taxpayers

to aid in the selection of cases predicted

to be at risk of noncompliance, choosing

enforcement treatments that maximize

opportunities to improve and sustain

taxpayer compliance while ensuring

fairness in selection

IRS IRA Strategic Operating Plan 63

Part II: Objectives and Initiatives