Page 110 - Form W4 and payroll Tables

P. 110

12:15 - 8-Dec-2020

Page 60 of 66

Fileid: … tions/P15T/2021/A/XML/Cycle06/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

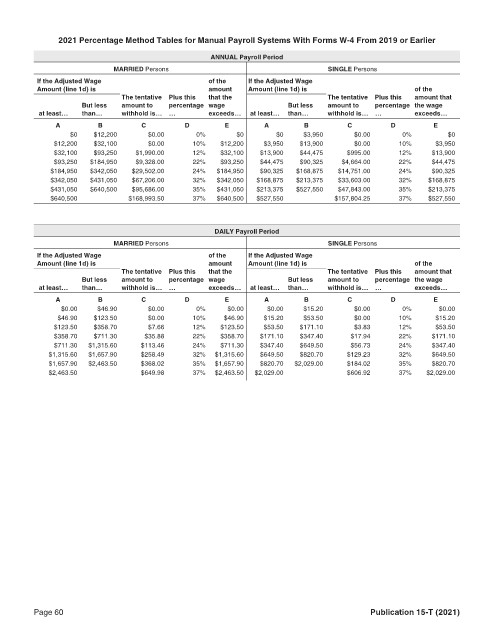

2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier

ANNUAL Payroll Period

MARRIED Persons SINGLE Persons

If the Adjusted Wage of the If the Adjusted Wage

Amount (line 1d) is amount Amount (line 1d) is of the

The tentative Plus this that the The tentative Plus this amount that

But less amount to percentage wage But less amount to percentage the wage

at least… than… withhold is… … exceeds… at least… than… withhold is… … exceeds…

A B C D E A B C D E

$0 $12,200 $0.00 0% $0 $0 $3,950 $0.00 0% $0

$12,200 $32,100 $0.00 10% $12,200 $3,950 $13,900 $0.00 10% $3,950

$32,100 $93,250 $1,990.00 12% $32,100 $13,900 $44,475 $995.00 12% $13,900

$93,250 $184,950 $9,328.00 22% $93,250 $44,475 $90,325 $4,664.00 22% $44,475

$184,950 $342,050 $29,502.00 24% $184,950 $90,325 $168,875 $14,751.00 24% $90,325

$342,050 $431,050 $67,206.00 32% $342,050 $168,875 $213,375 $33,603.00 32% $168,875

$431,050 $640,500 $95,686.00 35% $431,050 $213,375 $527,550 $47,843.00 35% $213,375

$640,500 $168,993.50 37% $640,500 $527,550 $157,804.25 37% $527,550

DAILY Payroll Period

MARRIED Persons SINGLE Persons

If the Adjusted Wage of the If the Adjusted Wage

Amount (line 1d) is amount Amount (line 1d) is of the

The tentative Plus this that the The tentative Plus this amount that

But less amount to percentage wage But less amount to percentage the wage

at least… than… withhold is… … exceeds… at least… than… withhold is… … exceeds…

A B C D E A B C D E

$0.00 $46.90 $0.00 0% $0.00 $0.00 $15.20 $0.00 0% $0.00

$46.90 $123.50 $0.00 10% $46.90 $15.20 $53.50 $0.00 10% $15.20

$123.50 $358.70 $7.66 12% $123.50 $53.50 $171.10 $3.83 12% $53.50

$358.70 $711.30 $35.88 22% $358.70 $171.10 $347.40 $17.94 22% $171.10

$711.30 $1,315.60 $113.46 24% $711.30 $347.40 $649.50 $56.73 24% $347.40

$1,315.60 $1,657.90 $258.49 32% $1,315.60 $649.50 $820.70 $129.23 32% $649.50

$1,657.90 $2,463.50 $368.02 35% $1,657.90 $820.70 $2,029.00 $184.02 35% $820.70

$2,463.50 $649.98 37% $2,463.50 $2,029.00 $606.92 37% $2,029.00

Page 60 Publication 15-T (2021)