Page 113 - Form W4 and payroll Tables

P. 113

12:15 - 8-Dec-2020

Page 63 of 66

Fileid: … tions/P15T/2021/A/XML/Cycle06/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

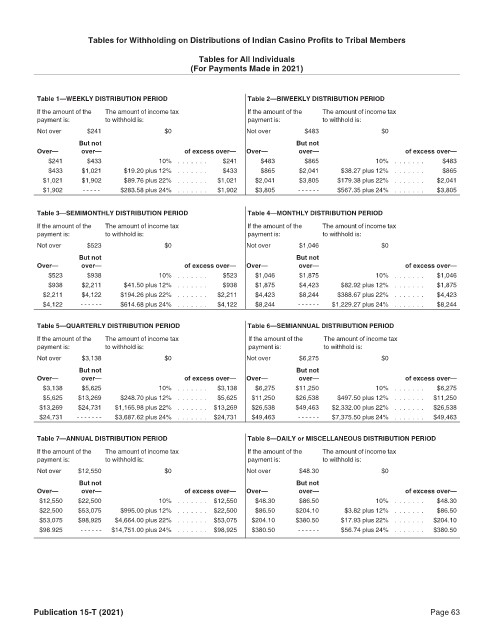

Tables for Withholding on Distributions of Indian Casino Profits to Tribal Members

Tables for All Individuals

(For Payments Made in 2021)

Table 1—WEEKLY DISTRIBUTION PERIOD Table 2—BIWEEKLY DISTRIBUTION PERIOD

If the amount of the The amount of income tax If the amount of the The amount of income tax

payment is: to withhold is: payment is: to withhold is:

Not over $241 $0 Not over $483 $0

But not But not

Over— over— of excess over— Over— over— of excess over—

$241 $433 10% . . . . . . . $241 $483 $865 10% . . . . . . . $483

$433 $1,021 $19.20 plus 12% . . . . . . . $433 $865 $2,041 $38.27 plus 12% . . . . . . . $865

$1,021 $1,902 $89.76 plus 22% . . . . . . . $1,021 $2,041 $3,805 $179.38 plus 22% . . . . . . . $2,041

$1,902 - - - - - $283.58 plus 24% . . . . . . . $1,902 $3,805 - - - - - - $567.35 plus 24% . . . . . . . $3,805

Table 3—SEMIMONTHLY DISTRIBUTION PERIOD Table 4—MONTHLY DISTRIBUTION PERIOD

If the amount of the The amount of income tax If the amount of the The amount of income tax

payment is: to withhold is: payment is: to withhold is:

Not over $523 $0 Not over $1,046 $0

But not But not

Over— over— of excess over— Over— over— of excess over—

$523 $938 10% . . . . . . . $523 $1,046 $1,875 10% . . . . . . . $1,046

$938 $2,211 $41.50 plus 12% . . . . . . . $938 $1,875 $4,423 $82.92 plus 12% . . . . . . . $1,875

$2,211 $4,122 $194.26 plus 22% . . . . . . . $2,211 $4,423 $8,244 $388.67 plus 22% . . . . . . . $4,423

$4,122 - - - - - - $614.68 plus 24% . . . . . . . $4,122 $8,244 - - - - - - $1,229.27 plus 24% . . . . . . . $8,244

Table 5—QUARTERLY DISTRIBUTION PERIOD Table 6—SEMIANNUAL DISTRIBUTION PERIOD

If the amount of the The amount of income tax If the amount of the The amount of income tax

payment is: to withhold is: payment is: to withhold is:

Not over $3,138 $0 Not over $6,275 $0

But not But not

Over— over— of excess over— Over— over— of excess over—

$3,138 $5,625 10% . . . . . . . $3,138 $6,275 $11,250 10% . . . . . . . $6,275

$5,625 $13,269 $248.70 plus 12% . . . . . . . $5,625 $11,250 $26,538 $497.50 plus 12% . . . . . . . $11,250

$13,269 $24,731 $1,165.98 plus 22% . . . . . . . $13,269 $26,538 $49,463 $2,332.00 plus 22% . . . . . . . $26,538

$24,731 - - - - - - - $3,687.62 plus 24% . . . . . . . $24,731 $49,463 - - - - - - $7,375.50 plus 24% . . . . . . . $49,463

Table 7—ANNUAL DISTRIBUTION PERIOD Table 8—DAILY or MISCELLANEOUS DISTRIBUTION PERIOD

If the amount of the The amount of income tax If the amount of the The amount of income tax

payment is: to withhold is: payment is: to withhold is:

Not over $12,550 $0 Not over $48.30 $0

But not But not

Over— over— of excess over— Over— over— of excess over—

$12,550 $22,500 10% . . . . . . . $12,550 $48.30 $86.50 10% . . . . . . . $48.30

$22,500 $53,075 $995.00 plus 12% . . . . . . . $22,500 $86.50 $204.10 $3.82 plus 12% . . . . . . . $86.50

$53,075 $98,925 $4,664.00 plus 22% . . . . . . . $53,075 $204.10 $380.50 $17.93 plus 22% . . . . . . . $204.10

$98.925 - - - - - - $14,751.00 plus 24% . . . . . . . $98,925 $380.50 - - - - - - $56.74 plus 24% . . . . . . . $380.50

Publication 15-T (2021) Page 63