Page 41 - Form W4 and payroll Tables

P. 41

9:19 - 23-Dec-2019

Page 39 of 48

Fileid: … ations/P15/2020/A/XML/Cycle07/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

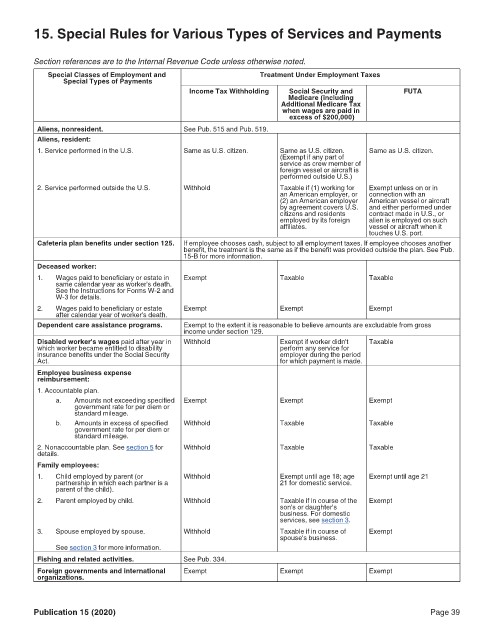

15. Special Rules for Various Types of Services and Payments

Section references are to the Internal Revenue Code unless otherwise noted.

Special Classes of Employment and Treatment Under Employment Taxes

Special Types of Payments

Income Tax Withholding Medicare (including FUTA

Social Security and

Additional Medicare Tax

when wages are paid in

excess of $200,000)

Aliens, nonresident. See Pub. 515 and Pub. 519.

Aliens, resident:

1. Service performed in the U.S. Same as U.S. citizen. Same as U.S. citizen. Same as U.S. citizen.

(Exempt if any part of

service as crew member of

foreign vessel or aircraft is

performed outside U.S.)

2. Service performed outside the U.S. Withhold Taxable if (1) working for Exempt unless on or in

an American employer, or connection with an

(2) an American employer American vessel or aircraft

by agreement covers U.S. and either performed under

citizens and residents contract made in U.S., or

employed by its foreign alien is employed on such

affiliates. vessel or aircraft when it

touches U.S. port.

Cafeteria plan benefits under section 125. If employee chooses cash, subject to all employment taxes. If employee chooses another

benefit, the treatment is the same as if the benefit was provided outside the plan. See Pub.

15-B for more information.

Deceased worker:

1. Wages paid to beneficiary or estate in Exempt Taxable Taxable

same calendar year as worker's death.

See the Instructions for Forms W-2 and

W-3 for details.

2. Wages paid to beneficiary or estate Exempt Exempt Exempt

after calendar year of worker's death.

Dependent care assistance programs. Exempt to the extent it is reasonable to believe amounts are excludable from gross

income under section 129.

Disabled worker's wages paid after year in Withhold Exempt if worker didn't Taxable

which worker became entitled to disability perform any service for

insurance benefits under the Social Security employer during the period

Act. for which payment is made.

Employee business expense

reimbursement:

1. Accountable plan.

a. Amounts not exceeding specified Exempt Exempt Exempt

government rate for per diem or

standard mileage.

b. Amounts in excess of specified Withhold Taxable Taxable

government rate for per diem or

standard mileage.

2. Nonaccountable plan. See section 5 for Withhold Taxable Taxable

details.

Family employees:

1. Child employed by parent (or Withhold Exempt until age 18; age Exempt until age 21

partnership in which each partner is a 21 for domestic service.

parent of the child).

2. Parent employed by child. Withhold Taxable if in course of the Exempt

son's or daughter's

business. For domestic

services, see section 3.

3. Spouse employed by spouse. Withhold Taxable if in course of Exempt

spouse's business.

See section 3 for more information.

Fishing and related activities. See Pub. 334.

Foreign governments and international Exempt Exempt Exempt

organizations.

Publication 15 (2020) Page 39