Page 45 - Form W4 and payroll Tables

P. 45

9:19 - 23-Dec-2019

Page 43 of 48

Fileid: … ations/P15/2020/A/XML/Cycle07/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

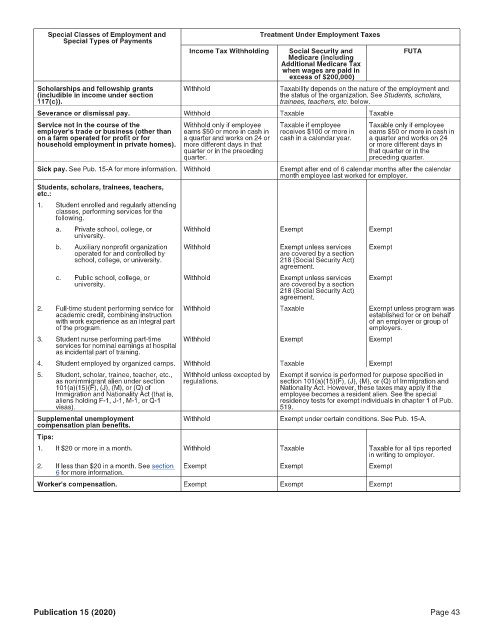

Special Classes of Employment and Treatment Under Employment Taxes

Special Types of Payments

Social Security and

Income Tax Withholding Medicare (including FUTA

Additional Medicare Tax

when wages are paid in

excess of $200,000)

Scholarships and fellowship grants Withhold Taxability depends on the nature of the employment and

(includible in income under section the status of the organization. See Students, scholars,

117(c)). trainees, teachers, etc. below.

Severance or dismissal pay. Withhold Taxable Taxable

Service not in the course of the Withhold only if employee Taxable if employee Taxable only if employee

employer's trade or business (other than earns $50 or more in cash in receives $100 or more in earns $50 or more in cash in

on a farm operated for profit or for a quarter and works on 24 or cash in a calendar year. a quarter and works on 24

household employment in private homes). more different days in that or more different days in

quarter or in the preceding that quarter or in the

quarter. preceding quarter.

Sick pay. See Pub. 15-A for more information. Withhold Exempt after end of 6 calendar months after the calendar

month employee last worked for employer.

Students, scholars, trainees, teachers,

etc.:

1. Student enrolled and regularly attending

classes, performing services for the

following.

a. Private school, college, or Withhold Exempt Exempt

university.

b. Auxiliary nonprofit organization Withhold Exempt unless services Exempt

operated for and controlled by are covered by a section

school, college, or university. 218 (Social Security Act)

agreement.

c. Public school, college, or Withhold Exempt unless services Exempt

university. are covered by a section

218 (Social Security Act)

agreement.

2. Full-time student performing service for Withhold Taxable Exempt unless program was

academic credit, combining instruction established for or on behalf

with work experience as an integral part of an employer or group of

of the program. employers.

3. Student nurse performing part-time Withhold Exempt Exempt

services for nominal earnings at hospital

as incidental part of training.

4. Student employed by organized camps. Withhold Taxable Exempt

5. Student, scholar, trainee, teacher, etc., Withhold unless excepted by Exempt if service is performed for purpose specified in

as nonimmigrant alien under section regulations. section 101(a)(15)(F), (J), (M), or (Q) of Immigration and

101(a)(15)(F), (J), (M), or (Q) of Nationality Act. However, these taxes may apply if the

Immigration and Nationality Act (that is, employee becomes a resident alien. See the special

aliens holding F-1, J-1, M-1, or Q-1 residency tests for exempt individuals in chapter 1 of Pub.

visas). 519.

Supplemental unemployment Withhold Exempt under certain conditions. See Pub. 15-A.

compensation plan benefits.

Tips:

1. If $20 or more in a month. Withhold Taxable Taxable for all tips reported

in writing to employer.

2. If less than $20 in a month. See section Exempt Exempt Exempt

6 for more information.

Worker's compensation. Exempt Exempt Exempt

Publication 15 (2020) Page 43