Page 217 - Small Business IRS Training Guides

P. 217

Qualified Business Income Deduction

COMPEHENSIVE EXAMPLE (CONTINUED)

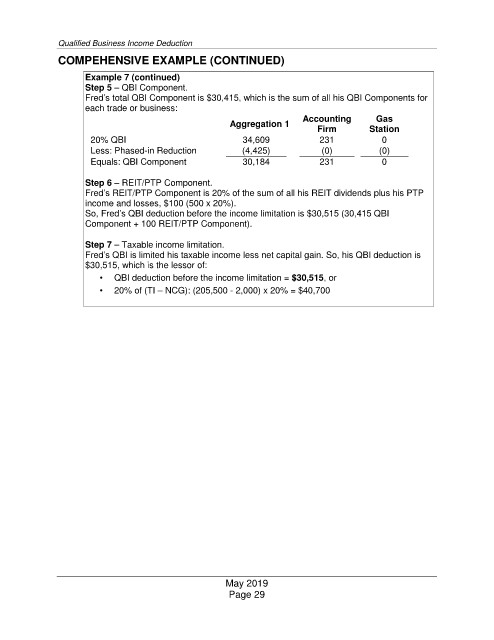

Example 7 (continued)

Step 5 –

QBI Component.

Fred’s total QBI Component is $30,415, which is the sum of all his QBI Components for

each trade or business:

Accounting Gas

Aggregation 1

Firm Station

20% QBI 34,609 231 0

Less: Phased-in Reduction (4,425) (0) (0)

Equals: QBI Component 30,184 231 0

Step 6 – REIT/PTP Component.

Fred’s REIT/PTP Component is 20% of the sum of all his REIT dividends plus his PTP

income and losses, $100 (500 x 20%).

So, Fred’s QBI deduction before the income limitation is $30,515 (30,415 QBI

Component + 100 REIT/PTP Component).

Step 7 –

Taxable income limitation.

Fred’s QBI is limited his taxable income less net capital gain. So, his QBI deduction is

$30,515, which is the lessor of:

• QBI deduction before the income limitation = $30,515, or

• 20% of (TI – NCG): (205,500 - 2,000) x 20% = $40,700

May 2019

Page 29