Page 212 - Small Business IRS Training Guides

P. 212

Qualified Business Income Deduction

HOW TO FIGURE THE DEDUCTION?

QBI COMPONENT

REDUCTIONS TO THE QBI COMPONENT

ABOVE THE THRESHOLD BUT WITHIN THE PHASE-IN RANGE (CONTINUED)

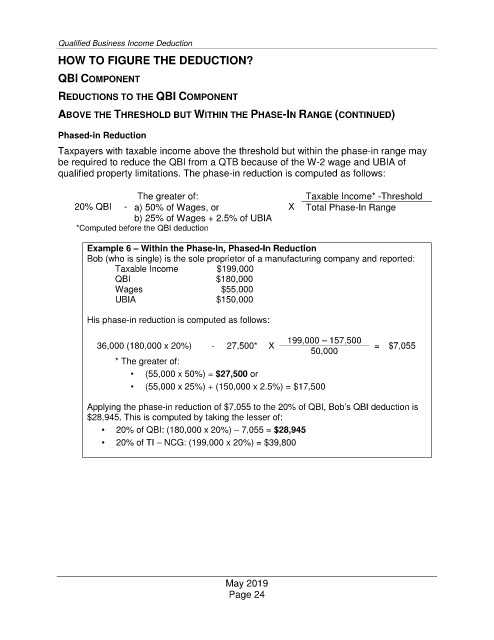

Phased-in Reduction

Taxpayers with taxable income above the threshold but within the phase-in range may

be required to reduce the QBI from a QTB because of the W-2 wage and UBIA of

qualified property limitations. The phase-in reduction is computed as follows:

The greater of: Taxable Income* -Threshold

20% QBI - a) 50% of Wages, or X Total Phase-In Range

b) 25% of Wages + 2.5% of UBIA

*Computed before the QBI deduction

Example 6 –

Within the Phase-In, Phased-In Reduction

Bob (who is single) is the sole proprietor of a manufacturing company and reported:

Taxable Income $199,000

QBI $180,000

Wages $55,000

UBIA $150,000

His phase-in reduction is computed as follows:

199,000 – 157,500

36,000 (180,000 x 20%) - 27,500* X = $7,055

50,000

* The greater of:

• (55,000 x 50%) = $27,500 or

• (55,000 x 25%) + (150,000 x 2.5%) = $17,500

Applying the phase-in reduction of $7,055 to the 20% of QBI, Bob’s QBI deduction is

$28,945. This is computed by taking the lesser of:

• 20% of QBI: (180,000 x 20%) – 7,055 = $28,945

• 20% of TI – NCG: (199,000 x 20%) = $39,800

May 2019

Page 24