Page 211 - Small Business IRS Training Guides

P. 211

Qualified Business Income Deduction

HOW TO FIGURE THE DEDUCTION?

QBI COMPONENT

Reductions to the QBI Component (continued)

Above the Threshold but Within the Phase-In Range

For taxpayers with taxable income above the threshold, but within the phase-in range,

the computation for the deduction is adjusted as follows:

1. QBI is reduced by the applicable percentage for SSTB,

2. W-2 wage and UBIA of qualified property limitations are phased in, and

3. The QBI Component is reduced by the Patron Reduction.

Taxpayers above the threshold, but within the phase-in range are allowed to consider a

portion of their SSTB business as a QTB. Their W-2 wage and UBIA of qualified

property limitations are phased-in. And, their QBI Component is reduced by the Patron

Reduction if they are a patron in a specified agricultural or horticultural cooperative.

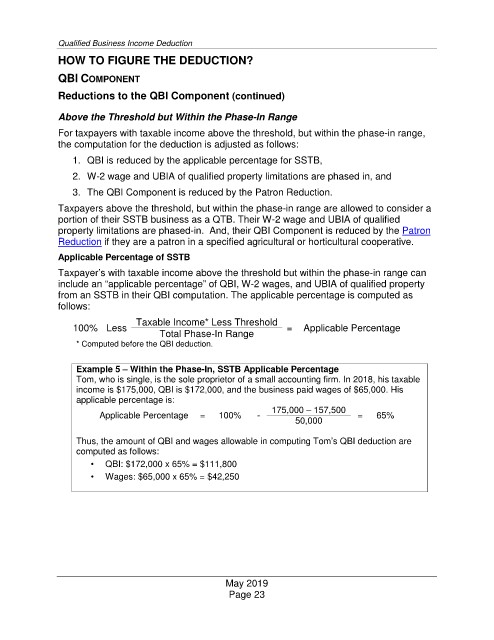

Applicable Percentage of SSTB

Taxpayer’s with taxable income above the threshold but within the phase-in range can

include an “applicable percentage” of QBI, W-2 wages, and UBIA of qualified property

from an SSTB in their QBI computation. The applicable percentage is computed as

follows:

Taxable Income* Less Threshold

100% Less = Applicable Percentage

Total Phase-In Range

* Computed before the QBI deduction.

Example 5 –

Within the Phase-In, SSTB Applicable Percentage

Tom, who is single, is the sole proprietor of a small accounting firm. In 2018, his taxable

income is $175,000, QBI is $172,000, and the business paid wages of $65,000. His

applicable percentage is:

175,000 – 157,500

Applicable Percentage = 100% - = 65%

50,000

QBI and wages allowable in computing Tom’s QBI deduction are

Thus, the amount of

computed as follows:

• QBI: $172,000 x 65% =

$111,800

• Wages: $65,000 x 65% = $42,250

May 2019

Page 23