Page 210 - Small Business IRS Training Guides

P. 210

Qualified Business Income Deduction

HOW TO FIGURE THE DEDUCTION?

QBI COMPONENT

Reductions to the QBI Component (continued)

Above the Threshold and Phase-in Range

For taxpayers with taxable income above the threshold and phase-in range, the

computation for the QBI deduction is adjusted as follows:

1. SSTB is excluded from the definition of QTB, resulting in the items from SSTB’s

being excluded from QBI,

2. W-2 wage and UBIA limitations apply, and

3. QBI Component is reduced by the Patron Reduction.

Taxpayers above the threshold and phase-in range do not get to include any portion of

their SSTBs as QTBs. So, all items from an SSTB are excluded in determining the QBI

deduction. In addition, QBI for each QTB is limited based on W-2 wages paid by the

QTB and/or the UBIA of qualified property used by the QTB. The limitation provides that

the QBI for each QTB is limited to the lesser of:

• 20% of QBI from the QTB, or

• The greater of:

• 50% of W-2 wages paid by the QTB, or

• 25% of W-2 wages plus 2.5% of the UBIA of qualified property held for use in

the QTB.

In addition, the QBI Component is reduced by the Patron Reduction if they are a patron

in a specified agricultural or horticultural cooperative.

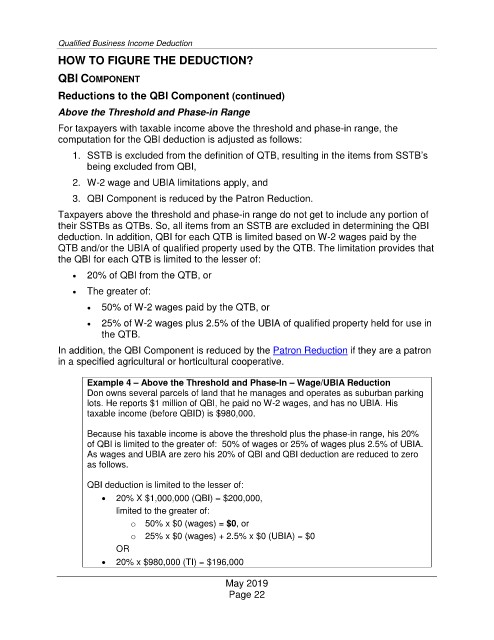

Example 4 –

Above the Threshold and Phase-In – Wage/UBIA Reduction

Don owns several parcels of land that he manages and operates as suburban parking

lots. He reports $1 million of QBI, he paid no W-2 wages, and has no UBIA. His

taxable income (before QBID) is $980,000.

Because his taxable income is above the threshold plus the phase-in range, his 20%

of QBI is limited to the greater of: 50% of wages or 25% of wages plus 2.5% of UBIA.

As wages and UBIA are zero his 20% of QBI and QBI deduction are reduced to zero

as follows.

QBI deduction is limited to the lesser of:

• 20% X $1,000,000 (QBI) = $200,000,

limited to the greater of:

o 50% x $0 (wages) = $0, or

o 25% x $0 (wages) + 2.5% x $0 (UBIA) = $0

OR

• 20% x $980,000 (TI) = $196,000

May 2019

Page 22