Page 208 - Small Business IRS Training Guides

P. 208

Qualified Business Income Deduction

HOW TO FIGURE THE DEDUCTION?

QBI COMPONENT

Reductions to the QBI Component (continued)

Threshold Amount and Phase-In Range

For 2018, the taxable income threshold is $315,000 for married individuals filing jointly

and $157,500 for all other taxpayers. These amounts are adjusted for inflation each

year. For the inflation adjustments see Rev. Proc 2018-59 or it successor.

The phase-in range is determined by taking the threshold amount plus $100,000 for

married individuals filing jointly or $50,000 for all other taxpayers. Therefore, the phase-

in range is:

• From $315,000.01 to $415,000 for married individuals filing jointly, and

• From $157,500.01 to $207,500 for all other taxpayers.

At or Below the Threshold

For taxpayers with taxable income at or below the threshold, the reduction to 20 percent

of QBI is not applicable. The QBI deduction is simply the QBI Component plus the

REIT/PTP Component, limited to 20 percent of taxable income (calculated before the

QBI deduction) less net capital gains. However, if the taxpayer is a patron of a specified

agricultural or horticultural cooperative the QBI Component is reduced by the Patron

Reduction.

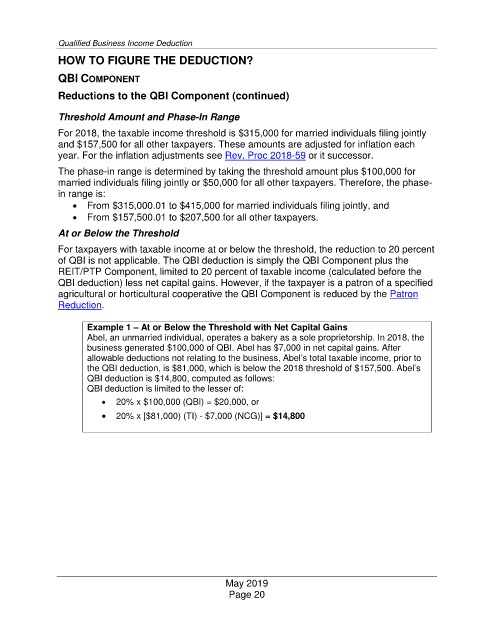

Example 1 – At or Below the Threshold with Net Capital Gains

Abel, an unmarried individual, operates a bakery as a sole proprietorship. In 2018, the

business generated $100,000 of QBI. Abel has $7,000 in net capital gains. After

allowable deductions not relating to the business, Abel’s total taxable income, prior to

the QBI deduction, is $81,000, which is below the 2018 threshold of $157,500. Abel’s

QBI deduction is $14,800, computed as follows:

QBI deduction is limited to the lesser of:

• 20% x $100,000 (QBI) = $20,000, or

• 20% x [$81,000) (TI) -

$7,000 (NCG)] = $14,800

May 2019

Page 20