Page 209 - Small Business IRS Training Guides

P. 209

Qualified Business Income Deduction

HOW TO FIGURE THE DEDUCTION?

QBI COMPONENT

Reductions to the QBI Component

At or Below the Threshold (continued)

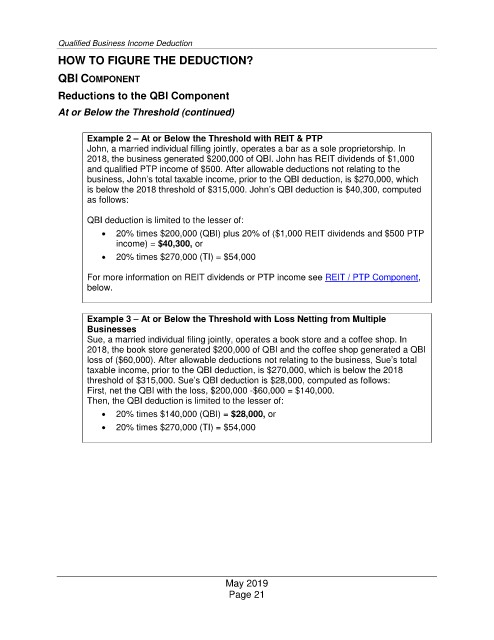

At or Below the Threshold with REIT & PTP

Example 2 –

John, a married individual filling jointly, operates a bar as a sole proprietorship. In

2018, the business generated $200,000 of QBI. John has REIT dividends of $1,000

and qualified PTP income of $500. After allowable deductions not relating to the

business, John’s total taxable income, prior to the QBI deduction, is $270,000, which

is below the 2018 threshold of $315,000. John’s QBI deduction is $40,300, computed

as follows:

QBI deduction is limited to the lesser of:

• 20% times $200,000 (QBI) plus 20% of ($1,000 REIT dividends and $500 PTP

income) = $40,300, or

• 20% times $270,000 (TI) = $54,000

For more information on REIT dividends or PTP income see REIT / PTP Component,

below.

Example 3 –

At or Below the Threshold with Loss Netting from Multiple

Businesses

Sue, a married individual filing jointly, operates a book store and a coffee shop. In

2018, the book store generated $200,000 of QBI and the coffee shop generated a QBI

loss of ($60,000). After allowable deductions not relating to the business, Sue’s total

taxable income, prior to the QBI deduction, is $270,000, which is below the 2018

threshold of $315,000. Sue’s QBI deduction is $28,000, computed as follows:

First, net the QBI with the loss, $200,000 -$60,000 = $140,000.

Then, the QBI deduction is limited to the lesser of:

• 20% times $140,000 (QBI) = $28,000, or

• 20% times $270,000 (TI) = $54,000

May 2019

Page 21