Page 216 - Small Business IRS Training Guides

P. 216

Qualified Business Income Deduction

COMPEHENSIVE EXAMPLE (CONTINUED)

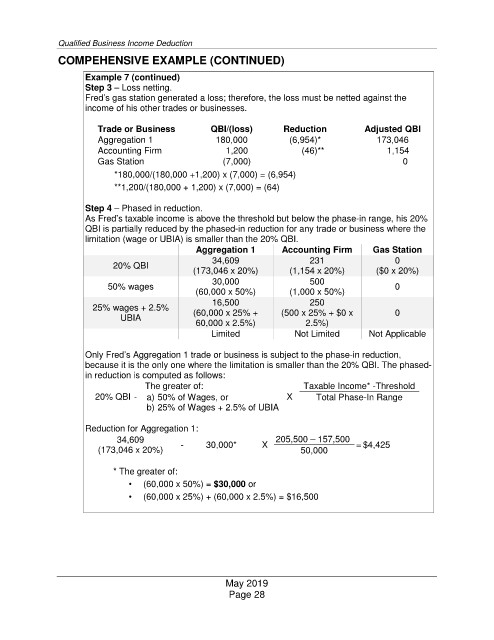

Example 7 (continued)

Step 3 – Loss netting.

Fred’s gas station generated a loss; therefore, the loss must be netted against the

income of his other trades or businesses.

Trade or Business QBI/(loss) Reduction Adjusted QBI

Aggregation 1 180,000 (6,954)* 173,046

Accounting Firm 1,200 (46)** 1,154

Gas Station (7,000) 0

*180,000/(180,000 +1,200) x (7,000) = (6,954)

**1,200/(180,000 + 1,200) x (7,000) = (64)

Step 4 –

Phased in reduction.

As Fred’s taxable income is above the threshold but below the phase-in range, his 20%

QBI is partially reduced by the phased-in reduction for any trade or business where the

limitation (wage or UBIA) is smaller than the 20% QBI.

Aggregation 1 Accounting Firm Gas Station

34,609

231

0

20% QBI

(173,046 x 20%)

(1,154 x 20%)

($0 x 20%)

30,000

500

50% wages

0

(60,000 x 50%)

(1,000 x 50%)

16,500

250

25% wages + 2.5%

(60,000 x 25% +

(500 x 25% + $0 x

0

UBIA

60,000 x 2.5%)

2.5%)

Limited

Not Limited

Not Applicable

Only Fred’s Aggregation 1 trade or business is subject to the phase-in reduction,

because it is the only one where the limitation is smaller than the 20% QBI. The phased-

in reduction is computed as follows:

The greater of: Taxable Income* -Threshold

20% QBI - a) 50% of Wages, or X Total Phase-In Range

b) 25% of Wages + 2.5% of UBIA

Reduction for Aggregation 1:

34,609 205,500 – 157,500

(173,046 x 20%) - 30,000* X 50,000 = $4,425

* The greater of:

• (60,000 x 50%) = $30,000 or

• (60,000 x 25%) + (60,000 x 2.5%) = $16,500

May 2019

Page 28