Page 177 - Volume 2_CHANGES_merged_with links

P. 177

Obstacles to progress

Realities

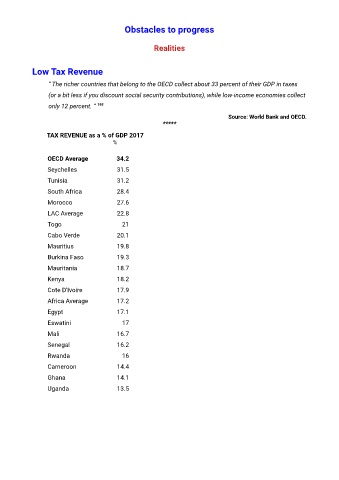

Low Tax Revenue

“ The richer countries that belong to the OECD collect about 33 percent of their GDP in taxes

(or a bit less if you discount social security contributions), while low-income economies collect

only 12 percent. “ 195

Source: World Bank and OECD.

*****

TAX REVENUE as a % of GDP 2017

%

OECD Average 34.2

Seychelles 31.5

Tunisia 31.2

South Africa 28.4

Morocco 27.6

LAC Average 22.8

Togo 21

Cabo Verde 20.1

Mauritius 19.8

Burkina Faso 19.3

Mauritania 18.7

Kenya 18.2

Cote D'Ivoire 17.9

Africa Average 17.2

Egypt 17.1

Eswatini 17

Mali 16.7

Senegal 16.2

Rwanda 16

Cameroon 14.4

Ghana 14.1

Uganda 13.5