Page 29 - Dec 2021 Report

P. 29

30 years - Our Journey Continues Investment/Finance Committee meeting minutes (draft) (2)

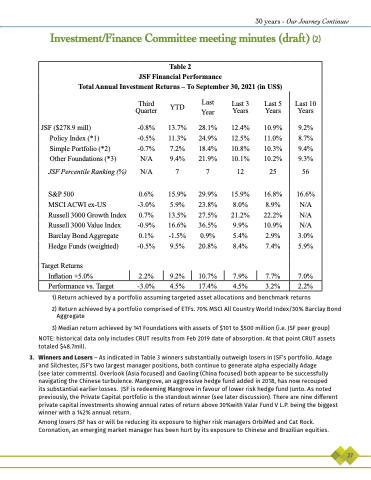

Table 2

JSF Financial Performance

Total Annual Investment Returns – To September 30, 2021 (in US$)

Third YTD Quarter

JSF ($278.9 mill) -0.8% 13.7% Policy Index (*1) -0.5% 11.3% Simple Portfolio (*2) -0.7% 7.2% Other Foundations (*3) N/A 9.4%

JSF Percentile Ranking (%) N/A 7 S&P 500 0.6% 15.9%

MSCI ACWI ex-US -3.0% 5.9% Russell 3000 Growth Index 0.7% 13.5% Russell 3000 Value Index -0.9% 16.6% Barclay Bond Aggregate 0.1% -1.5% Hedge Funds (weighted) -0.5% 9.5%

Target Returns

Inflation +5.0% 2.2% 9.2%

Last Year

28.1% 24.9% 18.4% 21.9%

7

29.9% 23.8% 27.5% 36.5% 0.9% 20.8%

10.7%

Last 3 Years

12.4% 12.5% 10.8% 10.1%

12

15.9% 8.0% 21.2% 9.9% 5.4% 8.4%

7.9%

Last 5 Years

10.9% 11.0% 10.3% 10.2%

25

16.8% 8.9% 22.2% 10.9% 2.9% 7.4%

7.7%

Last 10 Years

9.2% 8.7% 9.4% 9.3%

56

16.6% N/A N/A N/A 3.0% 5.9%

7.0%

Performance vs. Target -3.0% 4.5% 17.4% 4.5% 3.2%

2.2%

1) Return achieved by a portfolio assuming targeted asset allocations and benchmark returns

2) Return achieved by a portfolio comprised of ETFs. 70% MSCI All Country World Index/30% Barclay Bond Aggregate

3) Median return achieved by 141 Foundations with assets of $101 to $500 million (i.e. JSF peer group)

NOTE: historical data only includes CRUT results from Feb 2019 date of absorption. At that point CRUT assets totaled $48.7mill.

3. Winners and Losers – As indicated in Table 3 winners substantially outweigh losers in JSF’s portfolio. Adage and Silchester, JSF’s two largest manager positions, both continue to generate alpha especially Adage

(see later comments). Overlook (Asia focused) and Gaoling (China focused) both appear to be successfully navigating the Chinese turbulence. Mangrove, an aggressive hedge fund added in 2018, has now recouped

its substantial earlier losses. JSF is redeeming Mangrove in favour of lower risk hedge fund Junto. As noted previously, the Private Capital portfolio is the standout winner (see later discussion). There are nine different private capital investments showing annual rates of return above 30%with Valar Fund V L.P. being the biggest winner with a 142% annual return.

Among losers JSF has or will be reducing its exposure to higher risk managers OrbiMed and Cat Rock. Coronation, an emerging market manager has been hurt by its exposure to Chinese and Brazilian equities.

27