Page 31 - Dec 2021 Report

P. 31

30 years - Our Journey Continues Investment/Finance Committee meeting minutes (draft) (4)

* est. as at Mar 31/21

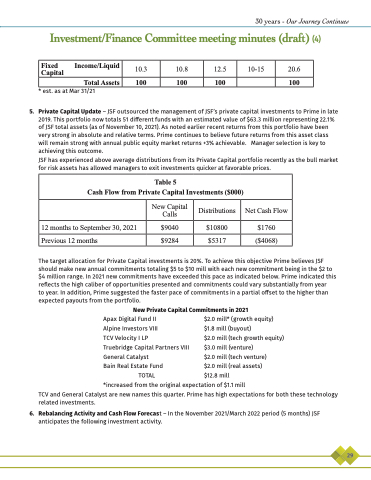

5. Private Capital Update – JSF outsourced the management of JSF’s private capital investments to Prime in late 2019. This portfolio now totals 51 different funds with an estimated value of $63.3 million representing 22.1% of JSF total assets (as of November 10, 2021). As noted earlier recent returns from this portfolio have been very strong in absolute and relative terms. Prime continues to believe future returns from this asset class will remain strong with annual public equity market returns +3% achievable. Manager selection is key to achieving this outcome.

JSF has experienced above average distributions from its Private Capital portfolio recently as the bull market for risk assets has allowed managers to exit investments quicker at favorable prices.

Fixed Income/Liquid Capital

10.3

10.8

12.5

10-15

20.6

Total Assets

100

100

100

100

Table 5

Cash Flow from Private Capital Investments ($000)

New Capital Calls

Distributions

Net Cash Flow

12 months to September 30, 2021

$9040

$10800

$1760

Previous 12 months

$9284

$5317

($4068)

The target allocation for Private Capital investments is 20%. To achieve this objective Prime believes JSF should make new annual commitments totaling $5 to $10 mill with each new commitment being in the $2 to $4 million range. In 2021 new commitments have exceeded this pace as indicated below. Prime indicated this reflects the high caliber of opportunities presented and commitments could vary substantially from year

to year. In addition, Prime suggested the faster pace of commitments in a partial offset to the higher than expected payouts from the portfolio.

New Private Capital Commitments in 2021

Apax Digital Fund II

Alpine Investors VIII

TCV Velocity I LP

Truebridge Capital Partners VIII General Catalyst

Bain Real Estate Fund TOTAL

$2.0 mill* (growth equity) $1.8 mill (buyout)

$2.0 mill (tech growth equity) $3.0 mill (venture)

$2.0 mill (tech venture) $2.0 mill (real assets) $12.8 mill

*increased from the original expectation of $1.1 mill

TCV and General Catalyst are new names this quarter. Prime has high expectations for both these technology related investments.

6. RebalancingActivityandCashFlowForecast–IntheNovember2021/March2022period(5months)JSF anticipates the following investment activity.

29