Page 32 - Dec 2021 Report

P. 32

December Report

30

Investment/Finance Committee meeting minutes (draft) (5)

Total

$11.0 mill

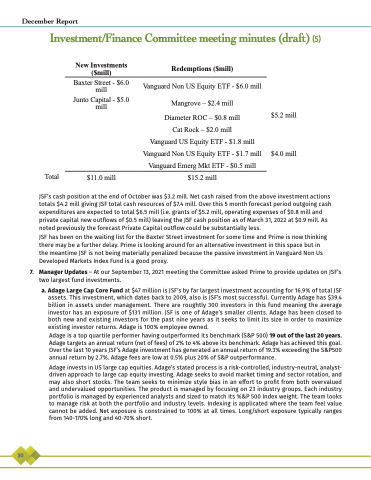

New Investments ($mill)

Baxter Street - $6.0 mill

Junto Capital - $5.0 mill

Redemptions ($mill)

Vanguard Non US Equity ETF - $6.0 mill

Mangrove – $2.4 mill

Diameter ROC – $0.8 mill

Cat Rock – $2.0 mill

Vanguard US Equity ETF - $1.8 mill Vanguard Non US Equity ETF - $1.7 mill Vanguard Emerg Mkt ETF - $0.5 mill $15.2 mill

$5.2 mill

$4.0 mill

JSF’s cash position at the end of October was $3.2 mill. Net cash raised from the above investment actions totals $4.2 mill giving JSF total cash resources of $7.4 mill. Over this 5 month forecast period outgoing cash expenditures are expected to total $6.5 mill (i.e. grants of $5.2 mill, operating expenses of $0.8 mill and private capital new outflows of $0.5 mill) leaving the JSF cash position as of March 31, 2022 at $0.9 mill. As noted previously the forecast Private Capital outflow could be substantially less.

JSF has been on the waiting list for the Baxter Street investment for some time and Prime is now thinking there may be a further delay. Prime is looking around for an alternative investment in this space but in the meantime JSF is not being materially penalized because the passive investment in Vanguard Non Us Developed Markets Index Fund is a good proxy.

7. Manager Updates – At our September 13, 2021 meeting the Committee asked Prime to provide updates on JSF’s two largest fund investments.

a. Adage Large Cap Core Fund at $47 million is JSF’s by far largest investment accounting for 16.9% of total JSF assets. This investment, which dates back to 2009, also is JSF’s most successful. Currently Adage has $39.4 billion in assets under management. There are roughtly 300 investors in this fund meaning the average investor has an exposure of $131 million. JSF is one of Adage’s smaller clients. Adage has been closed to both new and existing investors for the past nine years as it seeks to limit its size in order to maximize existing investor returns. Adage is 100% employee owned.

Adage is a top quartile performer having outperformed its benchmark (S&P 500) 19 out of the last 20 years. Adage targets an annual return (net of fees) of 2% to 4% above its benchmark. Adage has achieved this goal. Over the last 10 years JSF’s Adage investment has generated an annual return of 19.3% exceeding the S&P500 annual return by 2.7%. Adage fees are low at 0.5% plus 20% of S&P outperformance.

Adage invests in US large cap equities. Adage’s stated process is a risk-controlled, industry-neutral, analyst- driven approach to large cap equity investing. Adage seeks to avoid market timing and sector rotation, and may also short stocks. The team seeks to minimize style bias in an effort to profit from both overvalued and undervalued opportunities. The product is managed by focusing on 23 industry groups. Each industry portfolio is managed by experienced analysts and sized to match its %&P 500 Index weight. The team looks to manage risk at both the portfolio and industry levels. Indexing is applicated where the team feel value cannot be added. Net exposure is constrained to 100% at all times. Long/short exposure typically ranges from 140-170% long and 40-70% short.