Page 28 - DON'T MAKE ME SAY I TOLD YOU SO - ANNUITY CHAPTER ONLY

P. 28

Don’t Make Me Say I Told You So 184

Surrender Charges

If you withdraw money from a variable annuity within a certain

number of years after making the investment, a “surrender charge”

may apply. This is typically a four-to seven-year period, but it

varies by contract. Generally, the surrender charge is a percentage

of the amount withdrawn, and declines gradually over a period

of several years, known as the “surrender period.” The charge

typically declines each contract year until it reaches zero. Here are

two examples of annuity surrender charges:

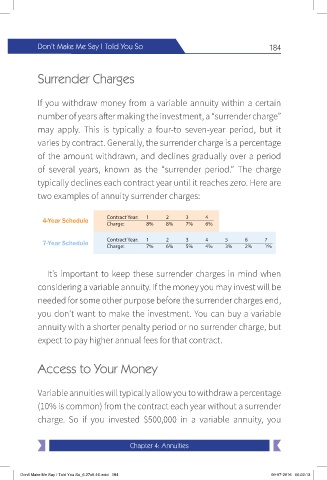

4-Year Schedule Contract Year: 1 8% 2 8% 3 4 6%

Charge:

7%

7-Year Schedule Contract Year: 1 2 3 4 5 6 7

Charge: 7% 6% 5% 4% 3% 2% 1%

It’s important to keep these surrender charges in mind when

considering a variable annuity. If the money you may invest will be

needed for some other purpose before the surrender charges end,

you don’t want to make the investment. You can buy a variable

annuity with a shorter penalty period or no surrender charge, but

expect to pay higher annual fees for that contract.

Access to Your Money

Variable annuities will typically allow you to withdraw a percentage

(10% is common) from the contract each year without a surrender

charge. So if you invested $500,000 in a variable annuity, you

Chapter 4: Annuities

Don't Make Me Say I Told You So_6.27x9.46.indd 184 09-07-2016 00:22:13