Page 32 - DON'T MAKE ME SAY I TOLD YOU SO - ANNUITY CHAPTER ONLY

P. 32

Don’t Make Me Say I Told You So 188

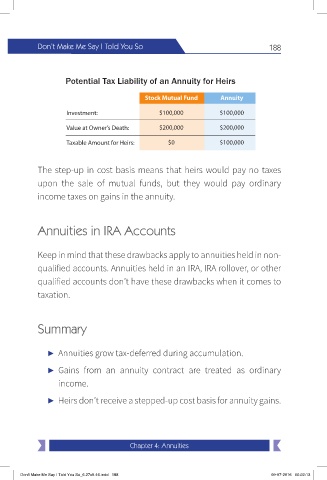

Potential Tax Liability of an Annuity for Heirs

Stock Mutual Fund Annuity

Investment: $100,000 $100,000

Value at Owner’s Death: $200,000 $200,000

Taxable Amount for Heirs: $0 $100,000

The step-up in cost basis means that heirs would pay no taxes

upon the sale of mutual funds, but they would pay ordinary

income taxes on gains in the annuity.

Annuities in IRA Accounts

Keep in mind that these drawbacks apply to annuities held in non-

qualified accounts. Annuities held in an IRA, IRA rollover, or other

qualified accounts don’t have these drawbacks when it comes to

taxation.

Summary

► Annuities grow tax-deferred during accumulation.

► Gains from an annuity contract are treated as ordinary

income.

► Heirs don’t receive a stepped-up cost basis for annuity gains.

Chapter 4: Annuities

Don't Make Me Say I Told You So_6.27x9.46.indd 188 09-07-2016 00:22:13