Page 35 - DON'T MAKE ME SAY I TOLD YOU SO - ANNUITY CHAPTER ONLY

P. 35

191 Don’t Make Me Say I Told You So

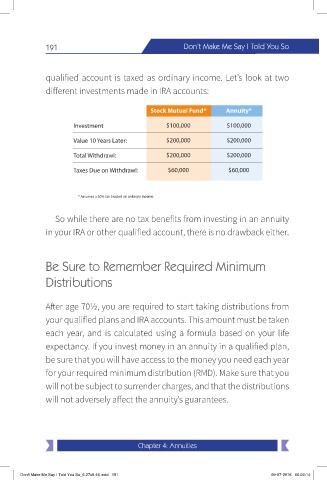

qualified account is taxed as ordinary income. Let’s look at two

different investments made in IRA accounts:

Stock Mutual Fund* Annuity*

Investment $100,000 $100,000

Value 10 Years Later: $200,000 $200,000

Total Withdrawl: $200,000 $200,000

Taxes Due on Withdrawl: $60,000 $60,000

* Assumes a 30% tax bracket on ordinary income.

So while there are no tax benefits from investing in an annuity

in your IRA or other qualified account, there is no drawback either.

Be Sure to Remember Required Minimum

Distributions

After age 70½, you are required to start taking distributions from

your qualified plans and IRA accounts. This amount must be taken

each year, and is calculated using a formula based on your life

expectancy. If you invest money in an annuity in a qualified plan,

be sure that you will have access to the money you need each year

for your required minimum distribution (RMD). Make sure that you

will not be subject to surrender charges, and that the distributions

will not adversely affect the annuity’s guarantees.

Chapter 4: Annuities

Don't Make Me Say I Told You So_6.27x9.46.indd 191 09-07-2016 00:22:14