Page 31 - DON'T MAKE ME SAY I TOLD YOU SO - ANNUITY CHAPTER ONLY

P. 31

187 Don’t Make Me Say I Told You So

1. All gains are considered to be withdrawn first when taken as

a lump-sum distribution or by systematic withdrawals. This

does not apply to annuitization.

2. All gains from the annuity are taxed as ordinary income at

your ordinary income tax rate.

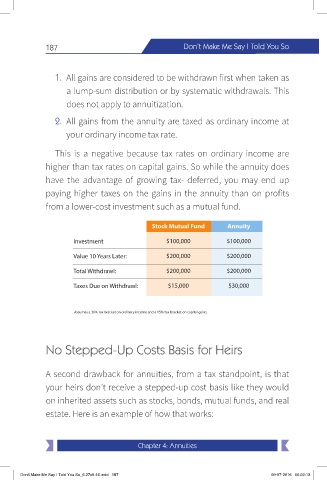

This is a negative because tax rates on ordinary income are

higher than tax rates on capital gains. So while the annuity does

have the advantage of growing tax- deferred, you may end up

paying higher taxes on the gains in the annuity than on profits

from a lower-cost investment such as a mutual fund.

Stock Mutual Fund Annuity

Investment $100,000 $100,000

Value 10 Years Later: $200,000 $200,000

Total Withdrawl: $200,000 $200,000

Taxes Due on Withdrawl: $15,000 $30,000

Assumes a 30% tax bracket on ordinary income and a 15% tax bracket on capital gains.

No Stepped-Up Costs Basis for Heirs

A second drawback for annuities, from a tax standpoint, is that

your heirs don’t receive a stepped-up cost basis like they would

on inherited assets such as stocks, bonds, mutual funds, and real

estate. Here is an example of how that works:

Chapter 4: Annuities

Don't Make Me Say I Told You So_6.27x9.46.indd 187 09-07-2016 00:22:13