Page 34 - DON'T MAKE ME SAY I TOLD YOU SO - ANNUITY CHAPTER ONLY

P. 34

Don’t Make Me Say I Told You So 190

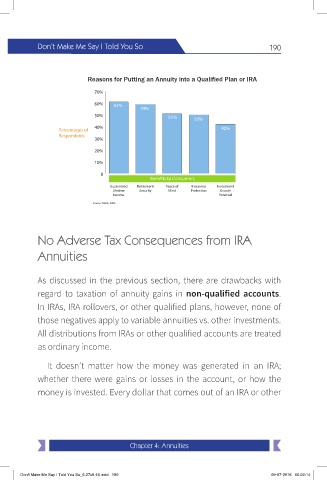

Reasons for Putting an Annuity into a Qualified Plan or IRA

70%

60% 61%

59%

50% 51% 50%

40%

Percentages of 42%

Respondents

30%

20%

10%

0

Bene ts to Consumers

Guaranteed Retirement Peace of Insurance Investment

Lifetime Security Mind Protection Growth

Income Potential

Source: NAVA, 2006

No Adverse Tax Consequences from IRA

Annuities

As discussed in the previous section, there are drawbacks with

regard to taxation of annuity gains in non-qualified accounts.

In IRAs, IRA rollovers, or other qualified plans, however, none of

those negatives apply to variable annuities vs. other investments.

All distributions from IRAs or other qualified accounts are treated

as ordinary income.

It doesn’t matter how the money was generated in an IRA;

whether there were gains or losses in the account, or how the

money is invested. Every dollar that comes out of an IRA or other

Chapter 4: Annuities

Don't Make Me Say I Told You So_6.27x9.46.indd 190 09-07-2016 00:22:14