Page 17 - How To Avoid Going Bust In Business

P. 17

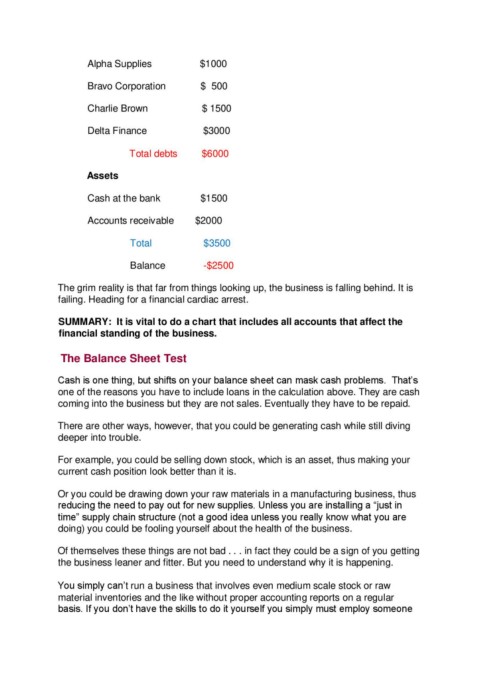

Alpha Supplies $1000

Bravo Corporation $ 500

Charlie Brown $ 1500

Delta Finance $3000

Total debts $6000

Assets

Cash at the bank $1500

Accounts receivable $2000

Total $3500

Balance -$2500

The grim reality is that far from things looking up, the business is falling behind. It is

failing. Heading for a financial cardiac arrest.

SUMMARY: It is vital to do a chart that includes all accounts that affect the

financial standing of the business.

The Balance Sheet Test

Cash is one thing, but shifts on your balance sheet can mask cash problems. That’s

one of the reasons you have to include loans in the calculation above. They are cash

coming into the business but they are not sales. Eventually they have to be repaid.

There are other ways, however, that you could be generating cash while still diving

deeper into trouble.

For example, you could be selling down stock, which is an asset, thus making your

current cash position look better than it is.

Or you could be drawing down your raw materials in a manufacturing business, thus

reducing the need to pay out for new supplies. Unless you are installing a “just in

time” supply chain structure (not a good idea unless you really know what you are

doing) you could be fooling yourself about the health of the business.

Of themselves these things are not bad . . . in fact they could be a sign of you getting

the business leaner and fitter. But you need to understand why it is happening.

You simply can’t run a business that involves even medium scale stock or raw

material inventories and the like without proper accounting reports on a regular

basis. If you don’t have the skills to do it yourself you simply must employ someone