Page 128 - 2021 ANNUAL REPORT draft

P. 128

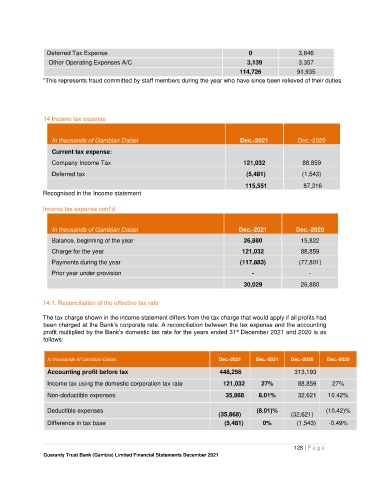

Deferred Tax Expense 0 3,646

Other Operating Expenses A/C 3,139 3,357

114,726 91,935

*This represents fraud committed by staff members during the year who have since been relieved of their duties

14 Income tax expense

In thousands of Gambian Dalasi Dec.-2021 Dec.-2020

Current tax expense:

Company Income Tax 121,032 88,859

Deferred tax (5,481) (1,543)

115,551 87,316

Recognised in the Income statement

Income tax expense cont’d

In thousands of Gambian Dalasi Dec.-2021 Dec.-2020

Balance, beginning of the year 26,880 15,822

Charge for the year 121,032 88,859

Payments during the year (117,883) (77,801)

Prior year under-provision - -

30,029 26,880

14.1. Reconciliation of the effective tax rate

The tax charge shown in the income statement differs from the tax charge that would apply if all profits had

been charged at the Bank’s corporate rate. A reconciliation between the tax expense and the accounting

profit multiplied by the Bank’s domestic tax rate for the years ended 31 December 2021 and 2020 is as

st

follows:

In thousands of Gambian Dalasi Dec.-2021 Dec.-2021 Dec.-2020 Dec.-2020

Accounting profit before tax 448,256 313,193

Income tax using the domestic corporation tax rate 121,032 27% 88,859 27%

Non-deductible expenses 35,868 8.01% 32,621 10.42%

Deductible expenses (8.01)% (10.42)%

(35,868) (32,621)

Difference in tax base (5,481) 0% (1,543) -0.49%

128 | P a g e

Guaranty Trust Bank (Gambia) Limited Financial Statements December 2021