Page 129 - 2021 ANNUAL REPORT draft

P. 129

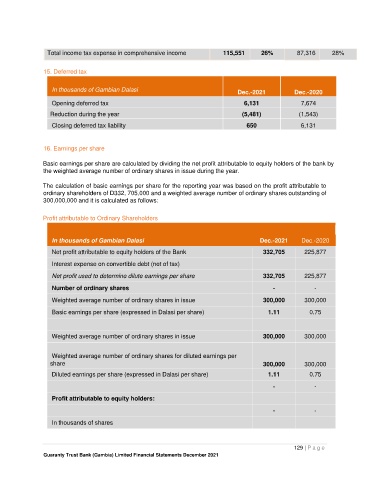

Total income tax expense in comprehensive income 115,551 26% 87,316 28%

15. Deferred tax

In thousands of Gambian Dalasi Dec.-2021 Dec.-2020

Opening deferred tax 6,131 7,674

Reduction during the year (5,481) (1,543)

Closing deferred tax liability 650 6,131

16. Earnings per share

Basic earnings per share are calculated by dividing the net profit attributable to equity holders of the bank by

the weighted average number of ordinary shares in issue during the year.

The calculation of basic earnings per share for the reporting year was based on the profit attributable to

ordinary shareholders of D332, 705,000 and a weighted average number of ordinary shares outstanding of

300,000,000 and it is calculated as follows:

Profit attributable to Ordinary Shareholders

In thousands of Gambian Dalasi Dec.-2021 Dec.-2020

Net profit attributable to equity holders of the Bank 332,705 225,877

Interest expense on convertible debt (net of tax)

Net profit used to determine dilute earnings per share 332,705 225,877

Number of ordinary shares - -

Weighted average number of ordinary shares in issue 300,000 300,000

Basic earnings per share (expressed in Dalasi per share) 1.11 0.75

Weighted average number of ordinary shares in issue 300,000 300,000

Weighted average number of ordinary shares for diluted earnings per

share 300,000 300,000

Diluted earnings per share (expressed in Dalasi per share) 1.11 0.75

- -

Profit attributable to equity holders:

- -

In thousands of shares

129 | P a g e

Guaranty Trust Bank (Gambia) Limited Financial Statements December 2021