Page 55 - GTBank Annual Report 2020 eBook

P. 55

The Bank’s Audit Committee is responsible for department, in carrying out these functions.

monitoring compliance with the risk management Internal Audit undertakes both regular and ad-hoc

policies and procedures, and for reviewing the reviews of risk management controls and

adequacy of the risk management framework in procedures, the results of which are reported to

relation to risks faced by the Bank. The Audit the Audit Committee.

Committee is assisted by the Internal Audit

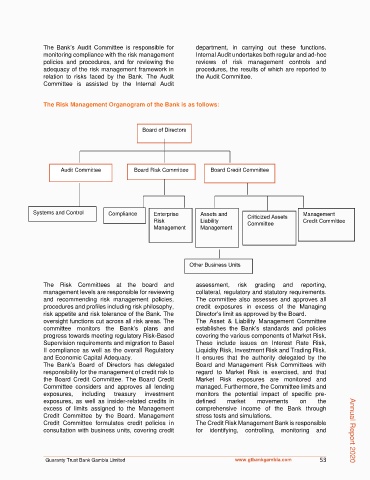

The Risk Management Organogram of the Bank is as follows:

Board of Directors

Audit Committee Board Risk Committee Board Credit Committee

Systems and Control Compliance Enterprise Assets and Criticized Assets Management

Risk Liability Committee Credit Committee

Management Management

Other Business Units

The Risk Committees at the board and assessment, risk grading and reporting,

management levels are responsible for reviewing collateral, regulatory and statutory requirements.

and recommending risk management policies, The committee also assesses and approves all

procedures and profiles including risk philosophy, credit exposures in excess of the Managing

risk appetite and risk tolerance of the Bank. The Director’s limit as approved by the Board.

oversight functions cut across all risk areas. The The Asset & Liability Management Committee

committee monitors the Bank’s plans and establishes the Bank’s standards and policies

progress towards meeting regulatory Risk-Based covering the various components of Market Risk.

Supervision requirements and migration to Basel These include issues on Interest Rate Risk,

II compliance as well as the overall Regulatory Liquidity Risk, Investment Risk and Trading Risk.

and Economic Capital Adequacy. It ensures that the authority delegated by the

The Bank’s Board of Directors has delegated Board and Management Risk Committees with

responsibility for the management of credit risk to regard to Market Risk is exercised, and that

the Board Credit Committee. The Board Credit Market Risk exposures are monitored and

Committee considers and approves all lending managed. Furthermore, the Committee limits and

exposures, including treasury investment monitors the potential impact of specific pre-

exposures, as well as insider-related credits in defined market movements on the

excess of limits assigned to the Management comprehensive income of the Bank through

Credit Committee by the Board. Management stress tests and simulations.

Credit Committee formulates credit policies in The Credit Risk Management Bank is responsible

consultation with business units, covering credit for identifying, controlling, monitoring and Annual Report 2020

Guaranty Trust Bank Gambia Limited www.gtbankgambia.com 53