Page 61 - GTBank Annual Report 2020 eBook

P. 61

The deposit required for all cash collateralized transactions, are not recognized in the annual

facilities (with the exception of bonds, guarantees financial statements but are disclosed when, as a

and indemnities) must be 125% of the facility result of past events, it is highly likely that

amount to provide a cushion for interest and other economic benefits will flow to the Bank, but this

charges. will only be confirmed by the occurrence or non-

Totally new facilities require one-up approval i.e. occurrence of one or more uncertain future

approval at a level higher than that of the person events which are not wholly within the Bank’s

that would ordinarily approve it. control.

Off-balance sheet engagements Contingent liabilities include transaction related

bonds and guarantees, letters of credit and short

These instruments are contingent in nature and term foreign currency related transactions.

carry the same credit risk as loans and advances. Contingent liabilities are not recognized in the

As a policy, the Bank ensures that all its off- annual financial statements but are disclosed in

balance sheet exposures are subjected to the the notes to the annual financial statements

same rigorous credit analysis, like that of the on- unless they are remote.

balance sheet exposures, before availment. The

major off-balance sheet items in the Bank’s books Placements

are Bonds and Guarantees, which the Bank will

only issue where it has full cash collateral or a The Bank has placement lines for its Bank

counter indemnity from a first class bank, or counterparties. The lines cover the settlement

another acceptable security. risks inherent in our activities with these

counterparties. The limits are arrived at after

Contingencies conducting fundamental analysis of the

counterparties, presentation of findings to, and

Contingent assets which include transaction approval by the Bank’s Management Credit

related bonds and guarantees, letters of credit Committee. The lines are monitored by Credit

and short term foreign currency related Risk Management Unit.

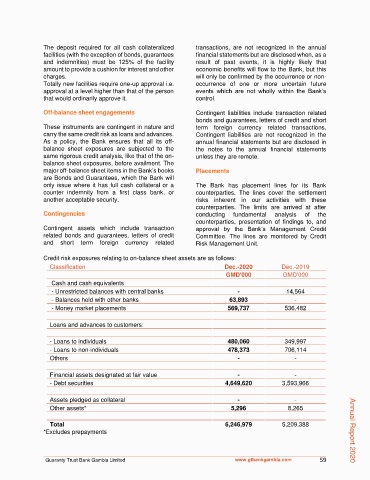

Credit risk exposures relating to on-balance sheet assets are as follows:

Classification Dec.-2020 Dec.-2019

GMD'000 GMD'000

Cash and cash equivalents

- Unrestricted balances with central banks - 14,564

- Balances held with other banks 63,893 -

- Money market placements 569,737 536,482

Loans and advances to customers:

- Loans to individuals 480,060 349,997

- Loans to non-individuals 478,373 706,114

Others - -

Financial assets designated at fair value - -

- Debt securities 4,649,620 3,593,966

Assets pledged as collateral - -

Other assets* 5,296 8,265

Total 6,246,979 5,209,388

*Excludes prepayments Annual Report 2020

Guaranty Trust Bank Gambia Limited www.gtbankgambia.com 59